Quote of the day

Jared Cummins, “There is no shame in a simple portfolio.” (Dividend.com)

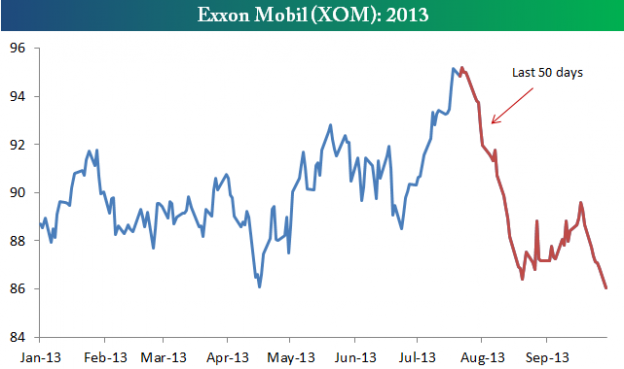

Chart of the day

What is going on with ExxonMobil ($XOM) stock? (Bespoke)

Markets

How global asset classes performed in September. (Capital Spectator)

The case for the stock market being fairly valued. (The Brooklyn Investor)

CFOs think their shares are overvalued. (Mark Hulbert)

Corn prices are at three-year lows. (FT)

Strategy

Ten terms investment pros use to gather assets. (The Reformed Broker)

Options selling is not income. (Morningstar)

David Merkel, “A model is only as good as the client’s willingness to use it.” (Aleph Blog)

Why you should make financial decisions that fit your needs not some billionaire’s needs. (Bucks Blog)

Trading

Has electronic trading ruined crude oil trading. (All About Alpha)

Why Wall Street traders behave badly. (The Guardian)

Institutions

There is now a crowdfunding portal for institutional funds. (Pando Daily)

Why do pension funds use outside investment consultants? (Dealbook)

Wall Street

The decline in stock listings is a global phenomenon. (Enterprising Investor)

Some one is now securitizing LendingClub loans. (Dealbook, FT)

Fewer MBAs are going to Wall Street. Good thing or bad? (Wonkblog, WSJ)

Funds

Do ETF flows tell us anything about investor sentiment? (Pensions & Investments)

How to pick active managers: tips from Vanguard. (Rekenthaler Report)

Before you sell a fund remind yourself why you bought it in the first place. (Humble Student)

The Vanguard Global Minimum Volatility Fund will go live this year. (IndexUniverse)

Global

Can Europe pull another rabbit out of its policy hat? (Minyanville)

Eastern Europe and Russia are getting increasingly old. (FT)

Economy

US manufacturing is on a roll. (Business Insider also Calculated Risk, Pragmatic Capitalism)

Earlier on Abnormal Returns

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Baseball is doing fine but it feels like it is falling behind. (NYTimes)

Was Breaking Bad a financial hit? (Time)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.