Quote of the day

John Authers, “This [closet indexing] is an effective tax on millions of investors, for no economic benefit, and helps pump up asset bubbles. It impedes capitalism and the efficient allocation of capital.” (FT)

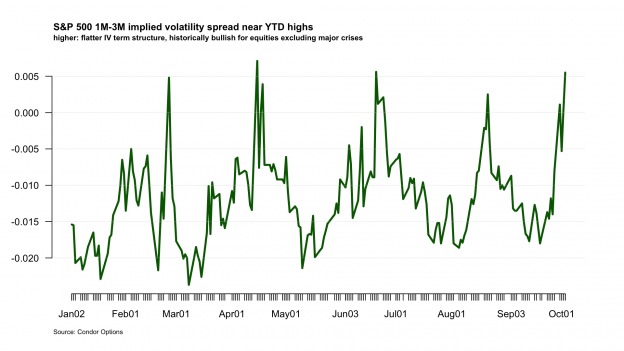

Chart of the day

The term spread in $VIX options is at levels associated historically with market bottoms. (Condor Options)

Markets

There are just less stocks in uptrends. (All Star Charts)

A pink sheets stock with a ticker similar to Twitter had an interesting morning. (Zero Hedge)

Strategy

It’s time to ditch the Yale Model. (The Exchange)

Ranking the prospects of various smart-beta regimes. (Morningstar)

How investors can sort through the noise when it comes to manager selection. (the research puzzle)

Twitter IPO

Twitter ($TWTR) files to public. (WSJ, Dealbook)

Twitter is not profitable, yet. (The Exchange)

Why Twitter is not going to have super-voting shares. (AllThingsD, FT)

Twitter is the “anti-Facebook.” (Pando Daily, Quartz, BI)

Does Twitter have a fake accounts problem? (WSJ)

Twitter is just beginning to monetize international users. (NYTimes)

Is Twitter really ready to be a public company? (Term Sheet)

Twitter’s IPO as a branding event. (ReadWrite)

How Twitter compares to other social media companies at IPO. (Digits)

The Twitter IPO marks the end of an era consumer-facing social media firms. (Term Sheet)

Finance

The online money management business model shifts towards a hybrid model. (Financial Planning)

The SEC now has the capability to track real-time market moves. (Businessweek)

Many brokers move from disgraced firm to another. (WSJ)

Economy

Rail traffic continues to expand. (Pragmatic Capitalism)

Earlier on Abnormal Returns

Embracing the grind, part two. (Abnormal Returns)

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

The story of a CEO who really did retire to spend more time with his family. (WSJ)

The new Kindle Fire HDX makes sense for hardcore Amazon users. (GigaOM)

Why server farms are being located in the Arctic. (Businessweek)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.