Quote of the day

DH, “The market has only three things it can do: annoy buyers, torment sellers, or frustrate everyone. Currently, the market is testing sellers and those who have not bought yet.” (Dynamic Hedge)

Chart of the day

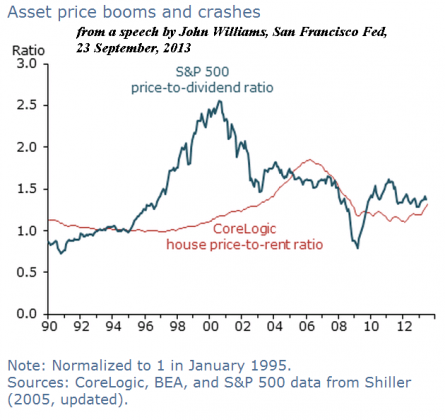

Bubbles are real. What should central bankers do in response? (Gavyn Davies)

Markets

David Rosenberg earns the wrath of permabears for changing his mind. (WSJ)

The market is overbought, including tech stocks. (Humble Student, Market Anthropology)

Margin debt hits a new high. (MarketBeat)

Valuations are looking stretched. (Dr. Ed’s Blog)

Take a look at 2014 earnings estimates. (A Dash of Insight)

Strategy

How to invest your “funny money.” (WSJ)

99% of long term investing is doing nothing. (Dumb Money)

These are the guys playing high beta stocks. (Bronte Capital)

Google and Apple

Google ($GOOG) wants cheap phone for everyone. (WSJ)

How much control does Google really have over Android? (ArsTechnica)

Is is bad news the iPhone 5S is crushing the 5C? (stratchery)

Why do developers still go with an Apple ($AAPL) first strategy? (Steve Cheney)

Finance

Has high-frequency trading really made trading cheaper? (Dealbook)

Don’t feel sorry for JP Morgan ($JPM). (Daniel Gross)

Funds

Six things you need to know about closed-end funds. (Morningstar)

Will the fund industry learn from Vanguard’s recent moves? (Chuck Jaffe)

Every asset manager is looking at actively managed ETFs. (Institutional Investor)

Economy

Good news: oil prices are dropping. (Bonddad Blog)

A lesson in simple economics: cheaper sugar is pushing candy manufacturing offshore. (WSJ)

On the dangers of a farmland bubble. (Marketwatch)

Earlier on Abnormal Returns

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Mixed media

Big media still does not understand social. (Brian Lund)

If you feel compelled to do something: don’t. (Tony Schwartz)

How to reinvent yourself. (Altucher Confidential)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.