Quote of the day

Morgan Housel, “The media is more interconnected and headline-hungry than ever. That means you, the investor, need to be as cautious and selective with how you get your information as ever.” (Motley Fool)

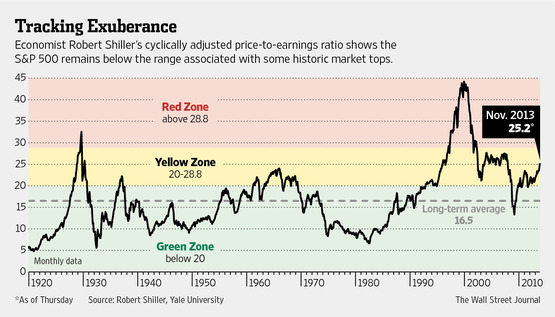

Chart of the day

Robert Shiller talks the CAPE ratio. (WSJ)

Markets

An alternative to the Shiller CAPE ratio. (Avondale Asset)

How to lie with charts – stock market crash edition. (Business Insider)

Gold analysts are pretty bearish. (Bloomberg also Focus on Funds)

Financials are showing relative strength. (Global Macro Monitor, Market Anthropology)

Fixed income

Why front-end TIPS are performing poorly. (FT Alphaville)

There has been a surge in convertible bond offerings. (Income Investing, Term Sheet)

Corporate credit is getting frothy. (Sober Look)

Strategy

Portfolio rebalancing prevents your portfolio from becoming a “gnarly mass of volatility and drawdowns.” (Bloomberg, Big Picture)

Howard Gold, “Genuine diversification sometimes means owning what you hate.” (Marketwatch)

In defense of risk parity strategies in a rising rate environment. (Institutional Investor)

What to do when you can’t find any stocks to buy. (Value Walk)

Have you considered how different the world could look in 2025? (Rick Bookstaber via research puzzle pieces)

IPOs

A look at the 2014 IPO calendar. (peHUB)

What ever happened to the open IPO process? (Continuations)

Companies

Where Facebook ($FB) sits on the social/communications map. (stratechery)

Microsoft ($MSFT) wants the Xbox One to be your new media/entertainment hub. (Quartz)

Finance

There are nearly 70,000 ‘high risk’ brokers. (WSJ)

Will 401(k) allocations to equities go much higher? (Attain Capital)

Why your blog should be the hub of your social media efforts. (InvestmentNews)

ETFs

A closer look at the PowerShares DWA Emerging Markets Momentum Portfolio ($PIE). (Morningstar)

Investors are still paying too much for their 529 plans. (Rekenthaler Report)

Economy

Holiday sales forecasts are pretty much useless. (Your Wealth Effect)

Household deleveraging seems to be over. (Bonddad Blog)

Rail traffic continues to trend higher. (Value Plays)

Earlier on Abnormal Returns

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

On the similarities between Bitcoin and the Segway. (The Atlantic)

Tough times ahead for newly minted MBAs. (HBR)

We now have a new world chess champion. (Business Insider)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.