Quote of the day

Horace Deidu, “The most reliable method of breakthrough creation is not the moonshot but a learning process that involves steady iteration. Small but profitable wins.” (Asymco)

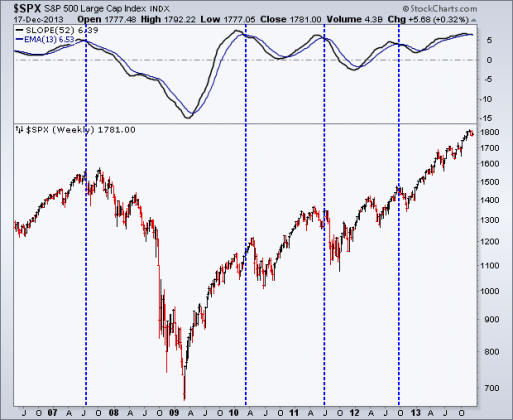

Chart of the day

The strength of the trend is degrading. (Andrew Thrasher)

Video of the day

Morgan Housel talks with Barry Ritholtz. (Motley Fool)

Markets

Gold market timers are not all that bearish. (Mark Hulbert)

Money is rushing out of commodity funds. (FT)

The case for closed-end muni bond funds. (Doug Kass)

Strategy

“The best performing stocks of 2014 will come from an industry very few people expect.” (Ivanhoff Capital)

On the limits of math when it comes to risk management. (Aleph Blog)

Don’t pay too much attention to any single day’s action. (A Dash of Insight)

Beware when chart makers superimpose two data series on each other. (Adam Grimes)

Buffett vs. Asness: on defining investment risk. (Turnkey Analyst)

The Shiller CAPE takes a beating. (Rekenthaler Report)

Food

The case to breakup Darden Restaurants ($DRI). (Dealbook)

Pizza chains want to pull a Chipotle ($CMG). (WSJ)

Companies

On the benefits of owning the GP in an MLP. (SL Advisors)

The existential risk for Facebook ($FB) is that it turns into Yahoo ($YHOO). (Business Insider)

Finance

Buyout investors are selling. Should you be buying? (Unexpected Returns, Term Sheet)

Goldman Sachs ($GS) is shrinking. (WSJ)

Bloomberg LP is trying to defend its trader chat product. (FT)

Mortgages are going to get more expensive next year. (WSJ)

Three things long-short hedge funds have a hard time doing. (FT Alphaville)

Fintech

Robinhood plans to offer zero commission, mobile-only trading next year. (TechCrunch, Pando Daily)

Can you use Twitter to gain investment knowledge? (The Reformed Broker)

Funds

Alternative funds ware plagued with fees on fees. (research puzzle pix)

Why a Bitcoin ETF ain’t happening any time soon. (Focus on Funds)

Economy

Housing starts surge. (Quartz)

The disappointments of the Bernanke era. (WSJ)

Why Abenomics will disappoint. (FT)

Earlier on Abnormal Returns

There is no such thing as an average year for the stock market. (Business Insider)

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Education

The value in music education for children. (Harvard Gazette)

Law school enrollment is collapsing. (Quartz, WSJ)

Time to thin the PhD herd. (Slate)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.