Quote of the day

Tyler Cowen, “We are not as smart as we think.” (Psychology Today)

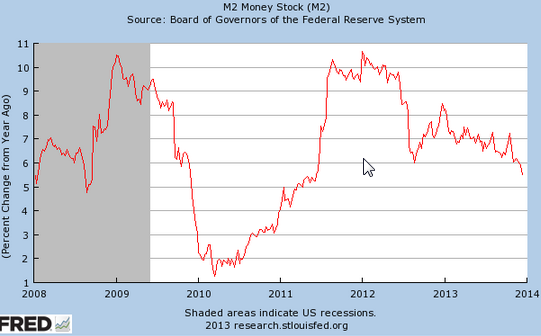

Chart of the day

US broad money supply growth is slowing. (Sober Look)

Markets

Why the stock market has favored junk over quality of late. (Mark Hulbert)

Investor sentiment: still (overly) bullish. (The Short Side of Long)

The number of companies that neither pay dividends or buyback stock is shrinking. (Horan Capital)

The rotation into stocks may just be getting started. (A Dash of Insight)

Strategy

The best investors are always trying to get better. (Dragonfly Capital)

On the role passion plays in your approach to investing. (Monevator)

William Bernstein, “Finance is never, ever, a theoretical exercise; you’re never half as detached from portfolio losses as you think you will be.” (WSJ)

Finding a “simple portfolio solution” is tougher than it looks. (Brett Arends)

When you should NOT buy an index fund. (Your Wealth Effect)

Companies

Teenagers are done with Facebook ($FB). (The Guardian)

2013 was not a lost year for Apple ($AAPL). (Daring Fireball)

Our whole economy is getting re-wired. (Howard Lindzon)

Finance

Everyone who believes in Bitcoin should try to answer this question. (Joe Weisenthal)

A convertible bond explainer. (Aleph Blog)

Economy

It’s hard to find much wrong with the 2014 economy. (Business Insider)

Is the labor participation rate set for another drop? (macroblog)

A look back at the economic week that was. (Bonddad Blog)

The economic schedule for the coming week. (Calculated Risk, Turnkey Analyst)

Earlier on Abnormal Returns

Preserving your investment bandwidth or how index-centric investing is like the Atkins diet. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Learning is a non-linear process. (Priceonomics Blog)

Are we equipped to deal with an era of advanced automation? (Tim Harford)

The Wolf of Wall Street as a new age Great Gatsby and/or companion piece to Goodfellas. (New Yorker)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.