Quote of the day

Daniel Gross, “There is one overlooked factor that can help explain the comparative buoyancy of the U.S. economy: the decline of financial failure.” (The Daily Beast)

Chart of the day

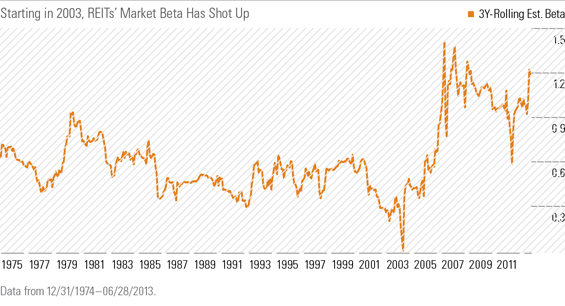

Do REITs really diversify your portfolio? (Morningstar)

Markets

13 technical signs that often preceded a major market top. (All Star Charts)

The best (and worst) performing industries in 2013. (TheArmoTrader, StockCharts Blog)

Junk bond spreads are now less than 400 bp below Treasuries. (Income Investing)

When will stock dispersion kick in again? (Condor Options)

Reasons for optimism for homebuilders. (Charts etc.)

Corn had a horrible year. (Quartz)

Predictions

The only predictions you need for 2014. (Big Picture)

Here are some bold stock market predictions. (InvestmentNews)

Strategy

Doing anything but holding US stocks in 2013 hurt performance. (WSJ)

Rebalancing now likely requires buying some emerging markets. (Burton Malkiel)

Why is everyone thinking so short-term these days? (Joe Fahmy)

More great financial advice. (Random Roger)

Companies

Don’t believe the hype that Facebook ($FB) is doomed. (Quartz, FT)

Seven big tech trends for 2014. (Mashable)

Netflix ($NFLX) is going to kill ‘freeloaders’ with kindness. (Quartz)

There will soon be Nordstrom Racks than regular Nordstroms ($JWN). (Buzzfeed Business)

Finance

Why do some directors/activist investors get to engage in “secret buybacks“? (WSJ)

2014 looks to be another tough year for small hedge funds. (Institutional Investor)

Global

Why it’s time to look at emerging markets value. (Institutional Investor)

China is still absorbing a lot of gold. (Institutional Investor)

Economy

The Fed is going to have to come up with some new operating rules. (Tim Duy)

Five structural reasons for higher profit margins. (Pragmatic Capitalism)

Home prices have yet to exceed replacement costs in many markets. (Conor Sen)

Earlier on Abnormal Returns

Check out the top clicks this year on Abnormal Returns. (Yahoo Finance)

What Abnormal Return posts readers got jazzed about this year. (Abnormal Returns)

The top ten books Abnormal Returns readers purchased in 2013. (Abnormal Returns)

New year’s financial resolutions: great minds think alike edition. (Abnormal Returns)

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

In 2013 I learned that….privacy is the new openness (see: SnapChat, Bitcoin, NSA, etc.). (The Reformed Broker)

Honda’s new jet is close to coming to market. (Speakeasy)

Does The Wolf of Wall Street glorify its many crimes? (Businessweek, Variety)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.