On the bookshelf: John Wasik’s Keynes’s Way to Wealth: Timeless Investment Lessons from the Great Economist.

Quote of the day

Rick Ferri, “The ETF acronym is no longer synonymous with low-cost benchmark indexing.” (Rick Ferri)

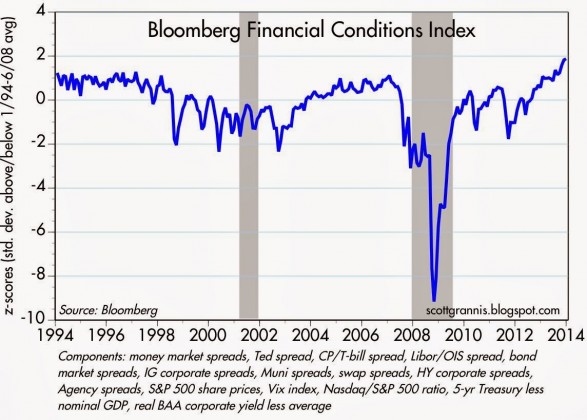

Chart of the day

The Bloomberg Financial Conditions Index is at a multi-decade high. (Calafia Beach Pundit)

Markets

Individual investor sentiment has ticked down. (Bespoke)

Barry Ritholtz, “It is easy to underestimate the depth of dislike for this market rally.” (Bloomberg)

Can you draw a conclusion from four data points? (Reformed Broker)

On the relationship between commodity prices and the stock market. (MoneyBeat)

Strategy

If an active manager can’t add value with stock correlations so low, then…. (FT)

Why it is so hard to not second-guess trades. (Kid Dynamite)

Guarding against rising interest rates comes with its own risks. (Morningstar)

On the need for portfolio balance in retirement. (Aleph Blog)

Companies

There are simply too many brick-and-mortar stores these days. (Re/code)

The big auction houses are increasing their financial risk to get high profile commissions. (NYTimes)

Finance

How Washington beat Wall Street. (Politico)

Crowdfunding is gearing up for the institutional set. (Institutional Investor)

Economy

Weekly initial unemployment claims continue to trend lower. (Calculated Risk)

Will housing fall prey to higher mortgage rates? (Bonddad Blog)

Why you can’t blame all economists for missing the financial crisis. (TheWeek)

Earlier on Abnormal Returns

Investing in your “personal capital” for the next decade. (Abnormal Returns)

What you missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Even the most vaunted startups are operating on the precipice of disaster. (Wired)

What Google ($GOOG) really wants from Google+. (Re/code)

Are curved TVs a true innovation or gimmick? (ArsTechnica)

Put your smartphone down after 9pm. (HBR)

You can support Abnormal Returns by visiting Amazon. You can also follow us on StockTwits and Twitter.