On the bookshelf: Brian Portnoy’s The Investor’s Paradox: The Power of Simplicity in a World of Choice.

Quote of the day

John Authers, “The raw facts are that a remarkable amount of money has been pulled out of EM with indecent haste; and that this was the first emerging market sell-off to be conducted mostly through ETFs.” (FT)

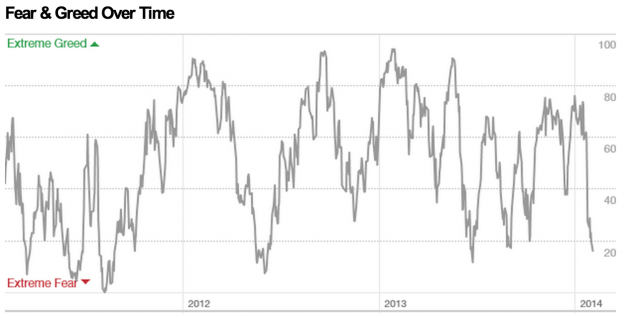

Chart of the day

Fear is rearing its ugly head again. (CNN via Andrew Thrasher)

Markets

How major asset classes performed in January 2014. (Capital Spectator)

Why muni bonds had a good January. (YCharts Blog, Income Investing)

A look at the quick turnaround in bond sentiment. (Chuck Jaffe)

The $VIX has a 20 handle. (Bespoke)

Strategy

Phil DeMuth, “In the long run, investors are hugely rewarded for avoiding big, preventable mistakes. Our lifetime investing returns are determined far more by our psychology than they are by our knowledge of the stock market.” (Forbes)

Why you should ignore the “January Barometer.” (Barry Ritholtz, Quantifiable Edges)

Updating the 60/40 portfolio. (ETF)

Technology

Can Apple ($AAPL) crack the mobile payment problem? (Minyanville)

You can’t have wearables without fixing the battery issue. (TechCrunch)

Tech companies love some of the same names. (SplatF)

Finance

Thomson Reuters ($TRI) is getting into the business of measuring Twitter sentiment. (TechCrunch)

What’s the most important job of a chief investment officer? (research puzzle pieces)

On the tricky question of hedge fund manager succession. (FT)

Private equity may have another tax problem. (Term Sheet)

Retirement savings

The history of the 401(k) plan. (Bloomberg earlier Abnormal Returns)

What would the USA Retirement Funds do for savers? (Rekenthaler Report)

The myRA is a good start. (Businessweek also Fortune)

Everything we know about the MyRA so far. (Nerd’s Eye View)

ETFs

Trades by ETF-only money managers are now moving markets. (WSJ)

Does selling calls on gold make a big difference in performance? (ETF)

John Bogle

How John Bogle changed the investment world. (Rick Ferri)

An Q&A with Knut Rostad author of The Man in the Arena: Vanguard Founder John C. Bogle and his Lifelong Battle to Serve Investor First. (ETF)

Economy

Corporate America is adjusting to the erosion of the middle class. (NYTimes)

The ISM Manufacturing report for January disappointed due to extreme weather. (Calculated Risk, Bespoke, Crossing Wall Street)

Bitcoin

The economics of Bitcoin. (Econbrowser)

Why Bitcoin will likely attract additional regulation. (Dealbook)

Earlier on Abnormal Returns

What books Abnormal Returns readers purchased in January. (Abnormal Returns)

What you missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

Why investment bankers never really retire. (efinancialcareers)

You can’t manage your time if you don’t know what you want. (Brooke Allen)

RIP, Philip Seymour Hoffman. (NYTimes, Slate, Esquire, Vulture, Quartz)

You can support Abnormal Returns by visiting Amazon. You can also follow us on StockTwits and Twitter.