Great for novice traders: The Little Book of Market Wizards: Lessons from the Greatest Traders by Jack Schwager.

Quote of the day

Joshua Brown, “It’s not different this time, it’s different every time…The simple fact is there are always too many variables for the chart overlay game to be able to call a crash, and the variables themselves are never the same.” (The Reformed Broker)

Chart of the day

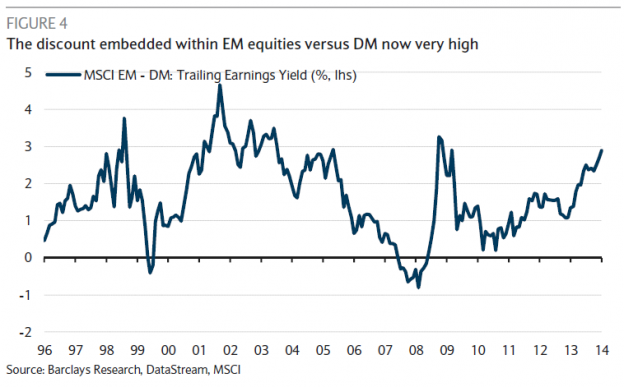

Emerging market equities are cheap but can get cheaper. (Long Short)

Markets

Where to go if commodity prices continue to push higher. (Market Anthropology)

A look at the muni market bounceback. (FT, Morningstar)

The really long term bear case for gold. (Daily Finance)

Should you sector-adjusted CAPE ratios? (Buttonwood)

Market timer sentiment has bounced back with the market. (Focus on Funds)

Strategy

Three investing lessons learned from a driver’s ed teacher. (Jason Zweig)

Daily correlations don’t say much about longer-term correlations. (Bloomberg)

How do you deal with the idea of ‘institutional herding‘? (the research puzzle)

Are stocks less risky over the long run? (Morningstar)

Two behaviors that hurt investors. (Rick Ferri)

Companies

Love the company, hate the stock: Amazon ($AMZN) edition. (Vitaily Katsenelson)

Cisco ($CSCO): still nothing to see here. (Herb Greenberg)

Warren Buffett wants to untangle his holdings in Graham Holdings ($GHC). (FT, Slate)

Finance

When the idea of “maximizing shareholder value” is dangerous. (Pragmatic Capitalism)

The IPO window is now wide open. (Term Sheet)

Comcast ($CMCSA) to merge with Time Warner Cable ($TWC). (Dealbook, WSJ, Quartz)

Regulatory risks abound. (NYMag, Slate)

Global

Why European stocks may not deserve a re-rating. (Dr. Ed’s Blog)

Behold a dose of humility at the world’s central banks. (Gavyn Davies)

Germans pay the highest electricity prices in Europe. (MoneyBeat)

Economy

Retail sales and weekly initial unemployment claims were disappointing. (Calculated Risk, ibid)

Farmland prices are beginning to fall. (WSJ)

Earlier on Abnormal Returns

The 2014 edition of the Credit Suisse Global Investment Returns Yearbook is out! (Abnormal Returns)

What you missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Should you pull back on your Twitter ($TWTR) usage. (Paul Lee)

Why hasn’t software eaten residential brokerage yet? (Brian Lund)

Why the office is a horrible place to get work done. (Fast Company)

Everybody, including VCs, are talking their book. (Points and Figures)

You can support Abnormal Returns by visiting Amazon. You can also follow us on StockTwits and Twitter.