You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

MS, “Though successful investing can be described very simply, implementation soon reveals an abyss of chaos and confusion lurking behind those simple ideas.” (Mortality Sucks)

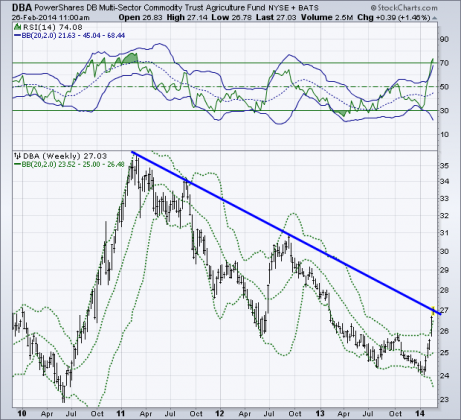

Chart of the day

The commodities rally may need a breather. (Andrew Thrasher)

Markets

Equal-weight and cap-weighted indices often tell different stories. (Dragonfly Capital)

Biotech stocks dominate the list of top Russell 2000 performers YTD. (Bespoke)

Everyone is talking about the James Montier paper on CAPEs. (Buttonwood)

Companies are issuing debt to buy back shares. (FT)

Why chasing Black Swans is a waste of time. (Capital Spectator)

Companies

Amazon ($AMZN) now wants to own your TV as well. (Wired)

John Gruber, “Without a focus on products, new technologies are a crapshoot.” (Daring Fireball)

Chinese manufacturers are flooding South America and India with cheap smartphones. (Business Insider)

How many ‘next Facebooks’ will Facebook ($FB) have to buy? (Slate, Quartz)

Finance

Howard Lindzon, “The big online brokerages are ruled by the compliance departments, not API’s.” (Howard Lindzon)

Venture capitalists are dying to disrupt banking. (Information Arbitrage)

JP Morgan ($JPM) is sitting on $30 billion in excess capital. (FT, Fortune)

Social media gaining importance as an investing tool for institutions. (MoneyBeat)

The three risks to Bitcoin. (Business Insider)

Pimco

Why everyone should back off Bill Gross. (Bloomberg View)

What it’s like to work at Pimco. (Quartz)

ETFs

How JP Morgan plans to play in the smart beta ETF space. (Focus on Funds)

Buyback ETFs are going global. (FT)

Why we need more bond ETFs. (ETF)

Comparing two ETFs that invest in closed-end funds. (ETF)

Global

On the continuing appeal of emerging market bonds. (Institutional Investor)

Did we learn anything from the financial crisis? (FT Alphaville)

Economy

Another measure by which the employment situation is looking better. (Dr. Ed’s Blog)

US household debt has started ticking up. (Sober Look)

It’s still cheaper to buy than rent in most housing markets. (Term Sheet)

The Fed really can’t fight asset bubbles until it is too late. (Tim Duy)

Earlier on Abnormal Returns

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

Ten value investing blogs to follow. (Wall Street Survivor)

CFA vs. MBA: which is better? (CNBC)

How to survive a conference call. (WSJ)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.