Quote of the day

Seth Klarman, “Any year in which the S&P 500 jumps 32 per cent and the Nasdaq 40 per cent while corporate earnings barely increase should be a cause for concern, not for further exuberance..” (FT)

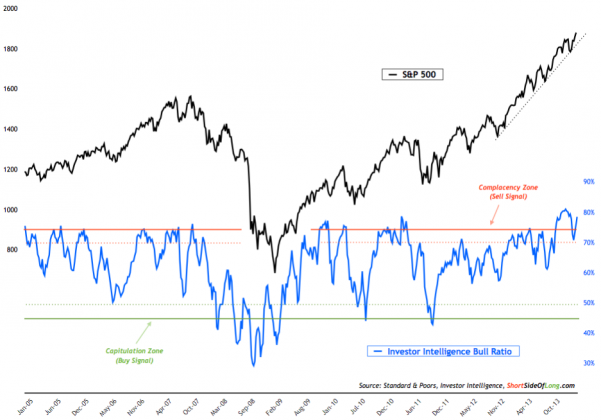

Chart of the day

Newsletter writers are still pretty bullish. (Short Side of Long)

Markets

This bull market is no longer hated. (Business Insider)

Does it matter if we are in a cyclical or secular bull market? (Humble Student)

Strategy

Howard Lindzon talks social finance with David Horowitz. (The Disciplined Investor)

Why dividend investing works. (Clear Eyes Investing)

A review of Greg Harmon’s Trading Options Using Technical Analysis to Design Winning Trades. (Reading the Markets)

401(k)s

Some companies are still willing to shell out for generous 401(k) plans. (Businessweek)

The 401(k) is not broken. (Barry Ritholtz)

Fixing the holes in your 401(k) plan. (Money)

Companies

Why is King Digital, makers of Candy Crush, willing to brave the public markets? (James Surowiecki)

Twitter ($TWTR) needs to globalize its revenue base. (FT)

Comparing the boards of eBay ($EBAY) and Icahn Enterprises ($IEP). (Jeff Matthews)

Why Apple’s ($AAPL) CarPlay is a great partner for automakers. (Minyanville)

Finance

Market inefficiency and the principal-agent problem in investment management. (FT)

An in-depth look at the Tiger Cubs network of hedge funds. (Novus via The Idea Farm)

Banks are increasingly getting out of the asset management business. (Sober Look)

Is COROA a better measure of profitability? (Fortune)

Funds

Rick Ferri, “Beta is neither smart nor dumb – it just is.” (Rick Ferri)

Is the low-vol anomaly robust? (Turnkey Analyst)

Economy

Houses get more expensive for first-time buyers as apartment building surges. (WSJ, ibid)

Why the Fed is now focused on wage growth. (Gavyn Davies)

Has commercial lending peaked? (Capital Spectator)

Capital in the Twenty-First Century by Thomas Piketty may be the most important book on economics this century. (Buttonwood)

Earlier on Abnormal Returns

Top clicks this past week on the site. (Abnormal Returns)

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Is Medium really a better way to write online? (Bits)

Vox wants to change how we read the news. (GigaOM)

There’s so much good television these days it is hard to keep up. (David Carr)

You can support Abnormal Returns by visiting Amazon. Don’t forget to follow us on StockTwits and Twitter.