Quote of the day

Jason Kottke, “Coffee, like almost everything else these days, is a sport.” (kottke)

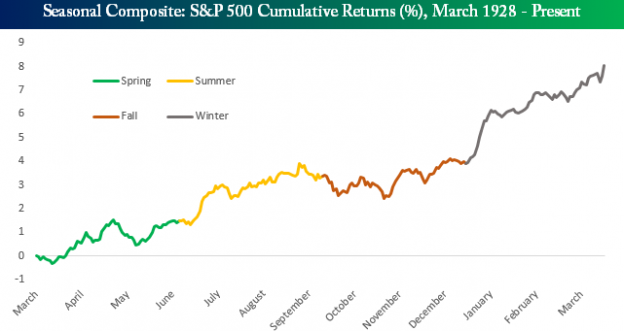

Chart of the day

Historical market performance by season. (Bespoke)

Markets

We just had the highest five year returns for high yield bonds…ever. (A Wealth of Common Sense)

How the rise of “financial warfare” may affect investors. (Business Insider)

Fitch just removed its “negative watch” on the US. (Schaeffer’s Trading Floor)

Commodities

The case for a palladium price squeeze. (Focus on Funds)

The copper selloff has accelerated. (The Short Side of Long)

How the new AccuShares “spot commodity” ETPs will work. (Bloomberg)

Strategy

Don’t get too clever by trying to time the market. (The Brooklyn Investor)

On the proper use of technical analysis: risk management. (Dragonfly Capital)

The four-factor model is now a five-factor model. (ETF)

Companies

How at-risk are hotels from disruption from the Airbnbs of the world? (TheStreet)

The outlines emerge of what Jeff Bezos may have in mind for the Washington Post. (Marginal Revolution)

Finance

How to rein in high-speed trading. (Points and Figures, WSJ, Themis Trading)

Why Bloomberg’s terminal business is stagnating. (Pando Daily)

Russia

How to choose among the Russia ETFs. (ETF)

US defense stocks are negatively correlated with Russian stocks. (Crossing Wall Street)

Economy

Is the Fed being too clear or not clear enough? (Bloomberg View, Minneapolis Fed, FT ALphaville)

Markets do not see much in the way of inflation. (Pragmatic Capitalism)

On the importance of car sales as an economic indicator. (House of Debt)

Earlier on Abnormal Returns

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Ten ways to be more like the Dalai Lama. (James Altucher)

Why you should hustle every day. (TheNextWeb)

Five things lucky people do every day. (Inc.)

You can support Abnormal Returns by visiting Amazon. Don’t forget to follow us on StockTwits and Twitter.