Quote of the day

John Authers, “From any given valuation, human nature being what it is, it is always possible for stocks to grow even more wildly cheap or expensive.” (FT)

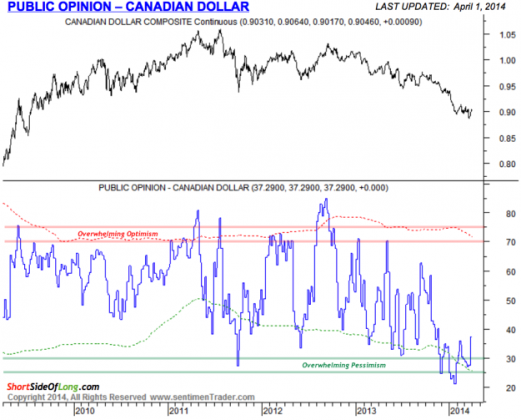

Chart of the day

Traders have little love for the Canadian dollar. (SentimenTrader via The Short Side of Long)

Markets

Investors have been lapping up IPOs this year. Wall Street is teeing more up. (The Reformed Broker)

The shift from new tech to old tech is now a theme. (Big Picture)

Investors are going for dividends. (WSJ)

The markets are undergoing some serious rotation. (Macro Man)

Companies

On spending Apple’s ($AAPL) big wad of cash. (Bits)

A review of postmodern computing. (Asymco)

Internet TV and Legacy TV are converging. (The Atlantic)

Finance

Whom can you trust with M&A rumors? (Quartz)

The SEC is investigating “unjustified fees and expenses” charged by private equity firms. (Businessweek)

Activist investors are attracting big bucks. (Marketwatch)

Hedge fund advertising is off to a slow start. (Dealbook)

HFT

“To what extent are our asset markets characterized by superfluous financial intermediation?” (Rajiv Sethi)

40% of stock trades happen off exchange. (Reuters)

A financial transaction tax is not a fix for HFT. (Daily Ticker)

Tyler Cowen “liked and enjoyed” Flash Boys: A Wall Street Revolt. Just don’t consider it a balanced view of HFT. (Marginal Revolution)

Michael Lewis’ book is more of an event than a fully realized book. (Felix Salmon)

Funds

Are non-transparent active ETFs about fees or performance? (Turnkey Analyst)

On the challenges of using ‘fulcrum fees‘ in mutual funds. (Marketwatch)

Global

Are the economy (and markets) simply too complex for us to understand? (Pragmatic Capitalism)

The future of real interest rates. (Gavyn Davies)

Economy

Good news! Tax witholding revenues are up. (Bloomberg View)

Mortgage origination has fallen off dramatically in Q1. (Quartz)

Why the growth in the Fed’s balance sheet should end this year. (Econbrowser)

US wind power is steadily rising. (Bloomberg)

Earlier on Abnormal Returns

Avoiding the personal finance monsters. (Abnormal Returns)

Recency bias in fund flows. (Business Insider)

What you may have missed in our Sunday linkfest. (Abnormal Returns)

Books

Recessions rarely come from out of the blue. A look at James Picerno’s Nowcasting The Business Cycle: A Practical Guide For Spotting Business Cycle Peaks Ahead Of The Crowd. (Capital Spectator)

A book list to build your master’s degree in investing including Success Equation: Untangling Skill and Luck in Business, Sports and Investing by Michael Mauboussin. (A Wealth of Common Sense)

Book picks from Bill and Melinda Gates including Getting Better: Why Global Development Is Succeeding–And How We Can Improve the World Even More by Charles Kenny. (Farnam Street)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.