Quote of the day

Howard Marks, “I’m convinced that everything that’s important in investing is counterintuitive, and everything that’s obvious is wrong. Staying with counterintuitive, idiosyncratic positions can be extremely difficult for anyone, especially if they look wrong at first.” (Oaktree Capital)

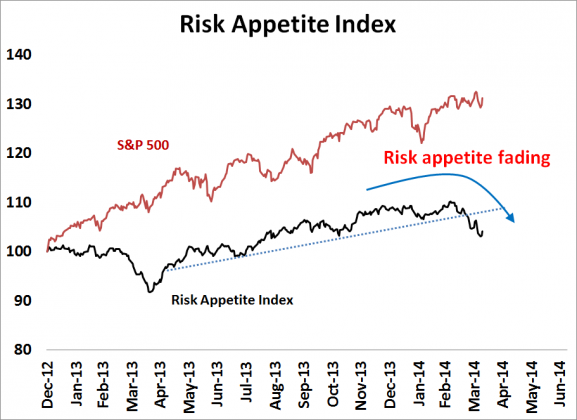

Chart of the day

Risk appetites are fading. (Humble Student of the Markets)

Strategy

The best traders in the world miss trades all the time. (Andrew Thrasher)

Great investments often look stupid at the outset. (Clear Eyes Investing)

Organics

Wal-Mart ($WMT) is muscling in on the organic food business. (Washington Post)

Whole Foods ($WFM) clones are having a hard time of it. (WSJ)

Technology

Comparing the ZenDesk and Box IPOs. (TechCrunch)

Why teens drive technology adoption. (Asymco)

Vintage business models are under assault everywhere. (Institutional Investor)

Did patent trolls pick on the wrong podcaster in Adam Carolla? (DailyFinance)

Finance pros

Why finance professionals need to think about their “brand.” (Brian Lund)

Young bankers are working the same hour just not on weekends. (Dealbook)

Finance

The SEC is a captured regulator. (Felix Salmon)

The definition of a MLP is getting stretched these days. (WSJ)

Michael Lewis’ Flash Boys: A Wall Street Revolt mistakenly emphasizes commercial solutions over regulatory ones. (Haim Bodek)

Wealthfront has a solution to the single stock diversification problem. (Michael Santoli)

Funds

Star fund managers still have to perform. (Quartz)

Two ETFs for the socially responsible crowd. (ETF)

Global

The fundamental problems facing Europe have not been fixed. (FT also Bloomberg View)

The misery index is falling around the world. (MoneyBeat, Dr. Ed’s Blog)

Economy

Weekly initial unemployment claims continue to trend at expansionary levels. (Calculated Risk, Crossing Wall Street)

Mortgage originations are at a 14-year low. (Real Time Economics)

Why Thomas Piketty’s Capital in the Twenty-First Century is a game-changer. (NY Books)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Why we shouldn’t encourage kids to drop out of college. (Recode)

Why people say they go to college: “Being very well off financially.” (EconLog)

Are internships more valuable than college majors? (Marginal Revolution)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.