Quote of the day

Carl Richards, “We can’t unbundle risk and return, but I keep seeing people giving it their best shot.” (Bucks Blog)

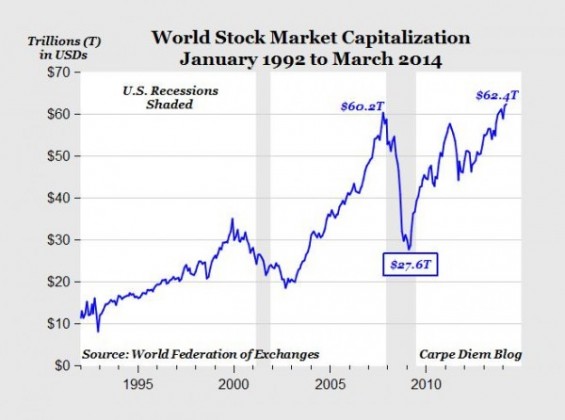

Chart of the day

As of March global stock markets stood at all-time highs in market cap terms. (Carpe Diem)

Markets

The earnings cycle is pretty weak. (The Reformed Broker, ibid)

How has the stock market done on tax day? (Quantifiable Edges)

The payoff to rebalancing varies over time. (Capital Spectator)

Markets are not pricing in much in the way of default risk. (FT)

Strategy

Great traders often have a “quirky” approach to markets. (TraderFeed)

Four steps to avoid money losing behaviors. (Chuck Jaffe)

Female investors are more “risk aware” not “risk averse.” (Above the Market)

How early life disasters affect CEO risk taking. (SSRN via @jasonzweigwsj)

Trading is a “team sport.” A list of worthwhile sites for traders. (TraderFeed)

Companies

Marissa Mayer’s job gets kicked into high gear post-Alibaba IPO. (Quartz also Risk Reversal)

Google ($GOOG) is buying another drone startup. (WSJ, TechCrunch)

Twitter ($TWTR) brings data reseller Gnip in-house. (Recode, Pando Daily)

News flash: corporate America has a whole host of juicy tax breaks. (Dealbook)

Online advice

Yet another online asset manager, Betterment, raises a big round from VCs. (TechCrunch)

Learnvest raised a big round as well. (BetaBeat)

How technology can improve financial planning. (Nerd’s Eye View)

Financial advisors have a choice about technology: use it to better serve clients or risk becoming obsolete. (Carl Richards)

The disruption of Wall Street is here. (The Felder Report)

Finance

The Nasdaq correction could not have come at a worse time for the IPO market. (FT)

The SEC is looking into the ‘maker-taker‘ market model. (WSJ)

The forex market is increasingly embracing options and futures. (Institutional Investor)

AngelList is now raising a fund to invest in the site’s angel investors. (Digits, FT)

Economy

Three signs the economy is perking up. (Fortune also BCA Research)

New homebuilder sentiment has leveled off. (Calculated Risk)

Why has US construction productivity been stagnant? (FT Alphaville)

Earlier on Abnormal Returns

Software is eating investment management. Get used to it. (Abnormal Returns)

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

On the high cost of procrastination. (Dan Ariely)

The psychology of persuasion. (Farnam Street)

Why you should take all your vacation time. (Fast Company)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.