Quote of the day

John Authers on Bob Swarup’s Money Mania: Booms, Panics, and Busts from Ancient Rome to the Great Meltdown, “Mental shortcuts and shortfalls in human perception virtually guarantee that speculative manias will take hold from time to time.” (FT)

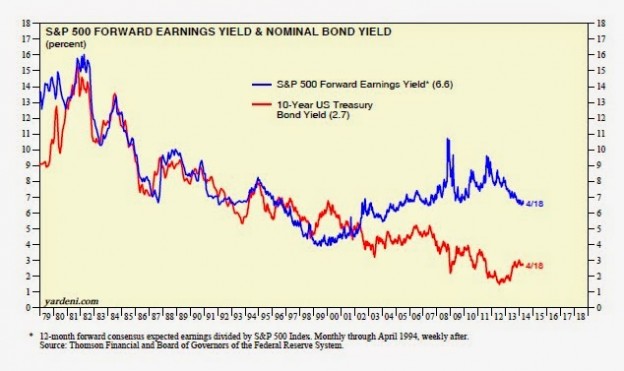

Chart of the day

A tale of two regimes. (Dr. Ed’s Blog)

Markets

The case for a flattish, frustrating year. (The Reformed Broker)

Risk appetites continue to wane. (Humble Student)

Small caps are still expensive and hedge funds are short. (WSJ also Bloomberg)

Check out the drop in commodity correlations with equities. (FT Alphaville)

Sorting through the “incentives and biases” of various market players. (Barry Ritholtz)

Strategy

The best way to weather the stresses of trading is to have a rich and full life outside of trading. (TraderFeed)

What CFOs are saying about the equity risk premium. (SSRN)

Why investors should be clear of the trade-offs in smart beta strategies. (SSRN)

On the challenges of manager selection. A review of Brian Portnoy’s The Investor’s Paradox: The Power of Simplicity in a World of Overwhelming Choice. (Aleph Blog)

Companies

What is Apple ($AAPL) going to do with the 1 billion credit card numbers it already has? (Business Insider)

Berkshire Hathaway ($BRKB) shares shine in down years. (A Wealth of Common Sense)

IBM ($IBM) is in no mood to take analyst questions. (Jeff Matthews)

Trading

Banks continue to back away from trading. (Quartz)

The future of forex trading is more robots. (MoneyBeat)

Private equity

Private equity is in harvest mode. (Fortune)

Does private equity kill jobs? (MoneyBeat)

Finance

Apple is prepping for another mega-bond deal. Why? (FT, Bloomberg)

Some big investors are shifting from buying distressed home to distressed mortgages. (Dealbook)

How “network science dashboards” will make for better decision making. (The Practical Quant)

Funds

Automated investment services are growing on the back of a generational change in investors. (ETF)

Can the SEC make target date funds easier to understand? (Chuck Jaffe)

Another example of why you shouldn’t mess around with structured notes. (Focus on Funds)

Global

Germany has a (low) inflation problem. (MoneyBeat)

Economy

Why are gasoline prices on the rise? (Econbrowser)

Don’t expect much from this week’s FOMC meetkng. (Tim Duy, Bloomberg)

Which economic data is actually worth following? (Calculated Risk)

Earlier on Abnormal Returns

Reveling in the messiness (of investing). (Abnormal Returns)

What you may have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

The blogophere lost something when it got corporatized. (Matthew Ingram)

Why you should try to achieve one big thing in the morning. (FT)

People are getting tired of their inaccurate fitness bands. (Bits)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.