Quote of the day

Martin Fridson, “It is a very favorable time for bond issuers…There is just a lot of money sloshing around out there. There are simply not a lot of alternatives, and money managers are under pressure to put that money to work.” (NYTimes)

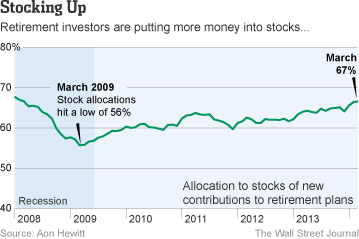

Chart of the day

Americans are once again loading up their 401(k)s with equities. (WSJ)

Markets

More signs the retail investor is back. (Humble Student)

“Easy money” is never easy. (Aleph Blog)

How to read the most recent GMO quarterly letter. (the research puzzle)

Research

Is ‘Sell in May‘ just an exercise in data mining? (Turnkey Analyst)

Why star analysts focus on ‘battleground stocks.’ (SSRN)

Companies

Don’t believe the hype: Twitter ($TWTR) is not dying. (Slate)

Twitter’s marketing problem. (Stratechery)

More signs that SnapChat is still on a roll. (Business Insider, ibid)

Finance

KKR ($KKR) wants smaller investors to pony up for its funds. (Dealbook)

A look at the now public Ares Management ($ARES). (The Brooklyn Investor)

Big news always leaks: the case of Herbalife ($HLF). (Dealbook)

Just how innovative is peer-to-peer lending? (FT Alphaville)

Funds

What you get in addition to dividends when you buy a dividend fund. (Focus on Funds)

Beware the future performance of backtested ETFs. (The Mathematical Investor)

Fund commentary including a review of the suite of Cambria-managed ETFs. (Mutual Fund Observer)

Seven smart-beta definitions that don’t work all that well. (ETF)

Economy

The April NFP numbers surprised to the upside. (Calculated Risk, Bonddad Blog, Quartz, Capital Spectator, Crackerjack Finance)

However the labor force continues to shrink. (The Upshot, Vox, Real Time Economics, BI, Bonddad Blog)

“Stuff” Americans buy is getting cheaper. Whereas the important stuff… (The Atlantic)

Why does the economic “cult of doom” still thrive? (Slate)

Earlier on Abnormal Returns

What books Abnormal Returns readers purchased in April 2014. (Abnormal Returns)

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

To achieve bigger goals focus on the here and now. (Business Insider)

Why “coworking spaces” are only likely to grow. (Points and Figures)

Warren Buffett aside, Omaha is booming. (Bloomberg View)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.