Quote of the day

Ari Weinberg, “When you are investing, you want to keep as much of your investment as possible, so the more you pay in fees, the less you keep.” (BBC)

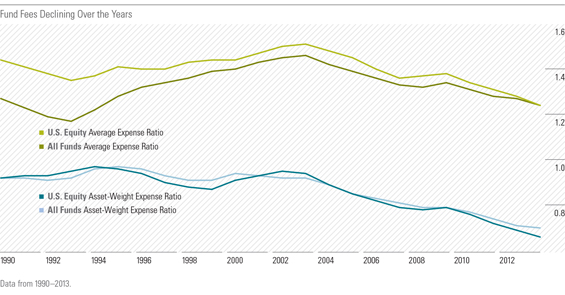

Chart of the day

Fund expense ratios are trending lower. (Morningstar)

Markets

Why interest rates have fallen in 2014. (WSJ, Business Insider)

Treasury market volatility is wicked low. (Pragmatic Capitalism)

Gold miners are once again oversold. (Short Side of Long)

Why your time frame matters. (The Irrelevant Investor)

Companies

Are the CEOs of Chipotle ($CMG) overpaid? (Dealbook)

How big an effect has Blackfish had on Seaworld ($SEAS) performance? (Vox)

Samsung is building out its capabilities in technology-enabled healthcare. (Quartz)

Should public companies be pouring money into startups? (Quartz)

Finance

Why hedge fund managers don’t care about carried interest. (Dealbook)

Is the story here that Porsche is selling ABS or that people borrow to buy Bentleys and Lamborghini? (WSJ)

ETFs

Three missed opportunities in some hot ETFs. (ETF)

Another look at commodities as a portfolio diversifier. (Larry Swedroe)

Global

Japan’s economy was red hot in in Q1. (FT, WSJ)

Look who now owns big slugs of Canadian dollar assets. (FT Alphaville)

Economy

Weekly initial unemployment claims are at pre-crisis levels. (Calculated Risk, Business Insider)

However industrial production in April was disappointing. (Calculated Risk)

US inflation is stabilizing. (Sober Look, Crossing Wall Street)

How Q2 GDP is tracking. (Capital Spectator, Econbrowser)

Can the US go into recession absent an inversion in the yield curve? (Market Anthropology)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Ezra Klein talks with Kevin Roose, author of Young Money: Inside the Hidden World of Wall Street’s Post-Crash Recruits, about how Wall Street hacked the recruitment process. (Vox)

“Thinking like a freak” requires experimentation according to Stephen Dubner co-author of Think Like a Freak: The Authors of Freakonomics Offer to Retrain Your Brain. (Big Think)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.