Quote of the day

chess, “The only permanence in life is impermanence–You should be willing to part with a long-term investment when you deem it to be objectively correct, regardless of the buy-and-hold-forever philosophy which has caused far more damage than many would care to admit.” (chessNwine)

Chart of the day

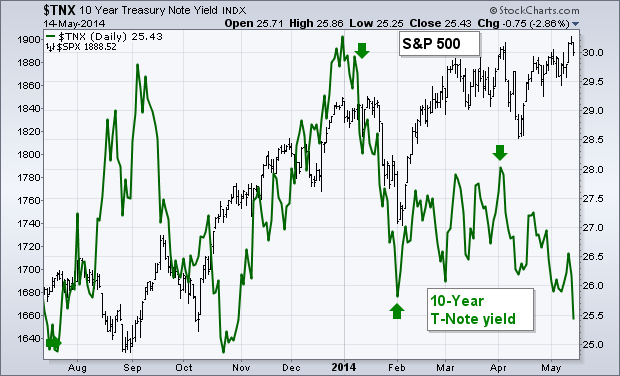

Which one of these markets is wrong? (John Murphy)

Markets

The great mystery of 2014 is why Treasury yields have declined. (The Reformed Broker)

Then again no one was suggesting utilities would outperform YTD. (ETF)

What does bond market strength say about the stock market? (A Dash of Insight, Financial Sense)

Investors are becoming more cautious about companies buying back shares. (Barron’s)

Checking in on how fund managers are positioned. (The Short Side of Long)

Strategy

Just how much cheaper are foreign stocks? (Jason Zweig)

It’s getting easier to invest in private equity. Should you? (WSJ)

Why younger investors should not necessarily want the stock market to go up. (Philosophical Economics)

Technology

Weird stuff happens when smartphones are cheap enough for everyone. (Wired)

Are headphones a ‘wearable’? (NYTimes)

Finance

Investors in the UK will soon be able to invest in a fund of peer-to-peer loans. (WSJ)

The challenges automated investment advisors will having going forward. (Daily Ticker)

ETFs

How much skin in the game does your manager have? (Mebane Faber)

Why ‘lazy portfolios‘ are so much cheaper than their active peers. (AssetBuilder)

Economy

Six reasons why Treasury yields should be higher. (Sober Look)

Thirteen important economic charts from the past week. (Quartz)

The economic schedule for the coming week. (Calculated Risk, Alpha Architect)

Ezra Klein sits down for an extended interview with Tim Geithner author of Stress Test: Reflections on Financial Crises. (Vox)

Economics curricula has not kept up with the times. (FT)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Most apps never reach critical mass. (Pando Daily)

Your phone is likely a cluster of “app constellations.” (A VC)

Why Pinterest is worth $5 billion. (Business Insider)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.