Quote of the day

Brett Steenbarger, “What are you really good at? If you’re going to succeed as a trader, it will because you’ve found a way to take signature strengths and apply them to financial markets.” (TraderFeed)

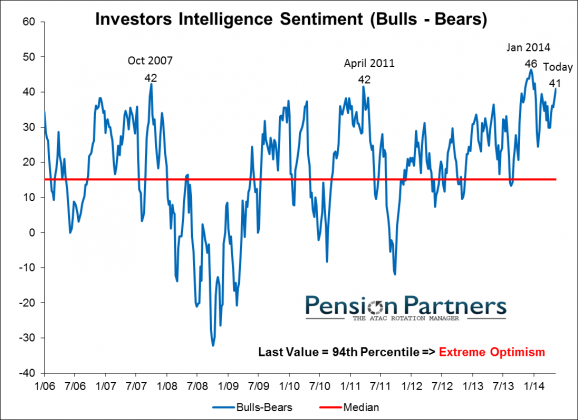

Chart of the day

Investor sentiment is once again sitting at historical highs. (Pension Partners)

Markets

A review of major asset class performance for May 2014. (Capital Spectator)

The S&P 500 has spent 80 straight weeks above the 200 day moving average. (The Short Side of Long)

Real yields are falling: why is gold dropping? (Sober Look)

Investors at present hate the miners. (The Short Side of Long)

Strategy

Value works: the case for price/cash flow. (Greenbackd)

Three classes of investors who should sell stocks now. (A Wealth of Common Sense)

Noise, noise everywhere. What are investors to do? (Mutual Fund Observer)

What does the research say about investors that use technical analysis? (Rick Ferri)

Companies

Five moves Satya Nadella, CEO of Microsoft ($MSFT), should make now. (WSJ)

The only WWDC previews you need. (Daring Fireball, stratechery)

You are going to be hearing a lot more about Apple’s ($AAPL) iBeacon. (WSJ)

Finance

Is Silicon Valley the future of finance? (Kevin Roose)

KKR ($KKR) finds that the hedge fund biz is tougher than it looks. (Dealbook)

Want to keep corporate activists at bay? Run your company well. (FT)

Global

Nobody understands the dynamics of now ultra-low bond yields. (Bloomberg)

Manufacturing was weak in Europe in May. (Business Insider)

India will have a huge impact on how the world consumes energy in the future. (Gregor Macdonald)

The MSCI FM is a POOR proxy for global frontier markets. (Investment Frontier also WSJ)

The world still wants American brands…for now. (Daniel Gross)

Economy

The ISM Manufacturing index is still in positive territory. (Calculated Risk, Bespoke)

Lease vs. buy: how Americans are procuring vehicles. (Quartz)

Americans are once again dining out. (Calculated Risk)

Earlier on Abnormal Returns

Distracted, unsure and unfocused: why you should consciously structure your news consumption. (Abnormal Returns)

What books Abnormal Returns readers purchased in May 2014. (Abnormal Returns)

What you may have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

The Amazon ($AMZN) consumer experience is deteriorating. (Slate)

The trick to making better predictions. (Barry Ritholtz)

What constitutes ‘good copying‘? (David Smith)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.