Quote of the day

William Sharpe, “I used to worry: what if there’s too much indexing? But human nature means people keep on backing active managers.” (FT)

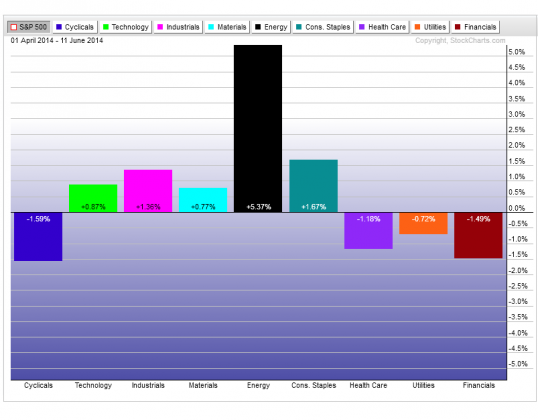

Chart of the day

Energy has been the runaway winner sector-wise in Q2. (All Star Charts)

Markets

On the back of geopolitical tensions, oil is surging. (Business Insider, TRB, Capital Spectator)

Individual investor sentiment has rapidly turned bullish. (Bespoke)

When real yields decline, metals tend to do well. (Market Anthropology also Short Side of Long)

Point, counterpoint

Are activist investors helping to push the general market up? (Joe Fahmy)

CEOs these days are “massaging capital” not actually putting it to work. (The Reformed Broker)

Strategy

Why you need to “own your mistakes.” (Barry Ritholtz)

Rick Ferri, “Successful market timing requires two correct decisions: when to get out and when to back get in. ” (Rick Ferri)

Mean reversion, in many fundamental series, is not guaranteed. (Philosophical Economics)

An early look at Nick Gogerty’s interesting, forthcoming book: The Nature of Value: How to Invest in the Adaptive Economy. (the research puzzle)

Companies

Boomer-led companies are anxious to get a piece of what kids are doing now. (New York)

Amazon ($AMZN) has joined the streaming music game. (The Verge, TechCrunch)

On the state of the cloud: from an investor’s perspective. (Dealbook)

Finance

Hello greenmail! Companies are paying off activists. (WSJ)

Investors are snapping up ultra-long dated corporate debt. (FT)

Commercial real estate is going the crowdfunding way. (WSJ)

Global

Can China avoid a severe housing downturn? (Sober Look)

The case for emerging markets. (Research Affiliates)

European stocks are no longer cheap. (FT Alphaville)

Economy

Retail sales ticked higher in May. (Calculated Risk)

America is becoming more polarized politically. (Pew Research, The Upshot)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Financial innovation at work: behold the ‘Burrito Bond.’ (MoneyBeat)

Is Uber presaging the end of car ownership? (Farhad Manjoo)

Now you can power your gadgets up at Starbucks ($SBUX). (TechCrunch)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.