Quote of the day

Ben Carlson, “Value investing is counterintuitive, can lead to large losses and comes with long periods of underperformance. That means the value premium isn’t going away anytime soon. (A Wealth of Common Sense)

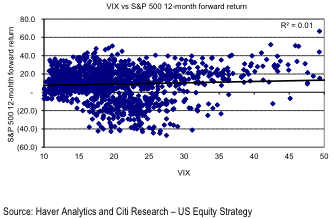

Chart of the day

Calm markets don’t tell us much about the future. (FT Alphaville)

Markets

Remember all those 1929 charts… (MoneyBeat)

Where did all the trading go? (Barry Ritholtz)

Some thoughts on the stretched bond market. (Aleph Blog)

Silver has broken out. (Short Side of Long)

Strategy

On the dangers of single variable analysis. (Barry Ritholtz)

On the dangers of diworsification. (Pragmatic Capitalism)

What factors drive the performance of momentum strategies. (CSS Analytics)

Institutional investors

Where did hedge funds’ alpha go? (Pension Partners)

Is the prudent investor a bad investor? (Ashby Monk)

Just how creative is your asset manager? (the research puzzle)

Do risk managers now have too much power? (Conor Sen)

Companies

American companies are finally slowing down their stock repurchases. (Pragmatic Capitalism)

Intuit ($INTU) has been on a shopping spree. What next? (Pando Daily)

Finance

The backlash against dark pools begins starting with Barclays. (WSJ, FT, Dealbook, Kid Dynamite)

With wider tick sizes the SEC is deliberately trying to make markets less efficient. (Matt Levine)

Boutiques are the new M&A darlings. (WSJ, MoneyBeat)

The big banks are launching a new venue to trade corporate bonds. (FT)

ETFs

Three bond funds taking a bunch of credit risk. (Morningstar)

How the $VIX ETP market went off track. (Focus on Funds)

Global

Emerging markets are finally coming back in investors’ eyes. (Bloomberg)

Macau’s gaming industry is facing a crisis. (Business Insider)

Economy

Things are still looking up for the US economy. (Calculated Risk)

Beware the auto loan market. (MarketBeat)

Earlier on Abnormal Returns

The problem with positive thinking: an excerpt from Tim Richards’ Investing Psychology: The Effects of Behavioral Finance on Investment Choice and Bias. (Abnormal Returns)

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Free broadcast TV is not all that free. (Felix Salmon also Justin Fox)

Should you track your iPhone activities? (Medium)

Five lessons for Millenials living in their parents’ basements. (Megan McArdle)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.