Quote of the day

James Montier, “When these strategies [smart beta] are corrected for their exposure to ‘value’ and ‘small,’ they exhibit no statistically significant outperformance compared to the cap weighted benchmark.” (NYTimes)

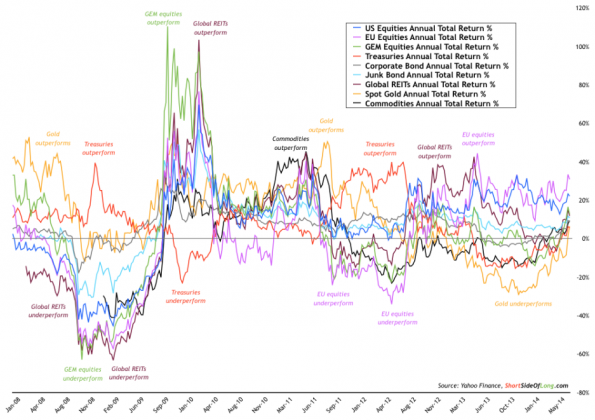

Chart of the day

All major asset classes are up over the past 12 months. (Short Side of Long)

Markets

Everything has rallied in 2014, yes everything. (WSJ, , Bespoke)

Where 10-year annualized stock returns stand. (HORAN Capital)

Ever wonder what the true global market portfolio looks like? (Meb Faber)

Why the coming week could be a big one for the stock market. (A Dash of Insight)

Strategy

Jason Zweig, “If you don’t ask questions about performance that was plucked out of the past, you are likely to end up disappointed about the returns you get in the future.” (MoneyBeat)

What is the key to factor investing? (Millenial Invest)

Do investors get paid to buy technology IPOs? (Wealthfront)

Just in case you are ever thinking of buying a promoted penny stock. (Aleph Blog)

Companies

Why the iPhone 6 is a much bigger deal than the iWatch. (Quartz)

What does Apple ($AAPL) have planned for its earbuds? (Business Insider)

Here’s a product idea for Twitter ($TWTR). (A VC, Business Insider)

Sears Holdings ($SHLD) has a cash flow problem. (Peridot Capital)

Finance

Lending Club is setting the stage for its own IPO. (WSJ, FT)

Big banks are now pushing auto loans. (Quartz)

On the state of Morgan Stanley ($MS) under James Gorman. (NYTimes)

Investors are looking to reverse their bulk purchases of distressed homes. (Dealbook)

Funds

How ETF model portfolios have changed the financial advisory game. (ETF)

Why aren’t Canadian investors taking advantage of index funds? (Dan Solin via Monevator)

Economy

Behold booming industrial production in America. (The Reformed Broker)

Chemical production is pointing toward higher growth. (Calculated Risk)

Are markets efficient? It depends. (NYTimes)

A look back at the economic week that was. (Bonddad Blog, Big Picture)

Strap in for a big week of economic news. (Joe Weisenthal, Calculated Risk)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What you might have missed in our Saturday linkfest. (Abnormal Returns)

The problem with positive thinking: an excerpt from Tim Richards’ Investing Psychology: The Effects of Behavioral Finance on Investment Choice and Bias. (Abnormal Returns)

Mixed media

On the soul of blogging. (Dave Winer, Om Malik)

On the demise of the timestamp. (Hunter Walk)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.