You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Benedict Evans, “(S)martphones don’t just increase the size of the internet by 2x or 3x, but more like 5x or 10x. It’s not just how many devices, but how different those devices are, that has the multiplier effect.” (Benedict Evans)

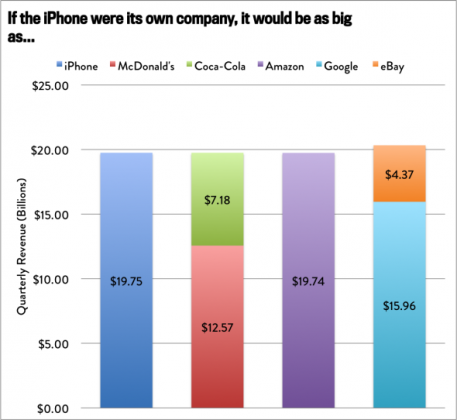

Chart of the day

If the Apple iPhone business were a standalone company… (Slate)

Markets

Why the narrative about emerging markets is like to shift. (The Irrelevant Investor)

A better measure of bond market sentiment. (Humble Student)

Beef prices are at all-time highs. (Bloomberg)

Strategy

How experts get better: they tune out the inessential. (TraderFeed)

Market inefficiencies are interesting only to the degree they can be exploited. (A Wealth of Common Sense)

On the return premium to illiquid stocks. (John Authers)

How would the Yale endowment invest if it were taxable? (SSRN via @quantivity)

Can individual investors time market bubbles? Some evidence says yes. (SSRN via The Whole Street)

Companies

Apple ($AAPL) earnings were driven by strong iPhone and weak iPad sales. (Quartz, TechCrunch, Vox, Business Insider)

The reviews for the Amazon Fire phone are rolling in and are mixed. (NYTimes, WSJ, Fast Company, The Verge, TechCrunch)

More 21st Century Fox ($FOXA) with Time Warner ($TWX) scuttlebut. (Bloomberg, WSJ)

Putting into perspective the Bill Ackman-Herbalife ($HLF) presentation. (Herb Greenberg)

Finance

Stephen Davidoff Solomon, “In other words, today’s outsize mergers are really about power.” (Dealbook)

Money market mutual funds finally see some fallout from the financial crisis. (Barry Ritholtz)

Big banks are firing traders and hiring lawyers. (Quartz)

ETFs

Many ETFs don’t sell themselves. (FT)

When two ETFs go head-to-head, investors often win. (ETF)

Global

Russia’s stock market is quite a drag on the BRICs. (Dr. Ed’s Blog)

Economy

Seven optimistic charts about the American economy. (Quartz)

Earlier on Abnormal Returns

An excerpt on bond ETFs from William Bernstein’s Rational Expectations: Asset Allocation for Investing Adults. (Abnormal Returns)

What you might have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

Why a one-size-fits-all work schedule is a recipe for conflict. (Wonkblog)

Why intuition is difficult to interpret. (Jason Voss)

How to hack air travel. (Medium via kottke)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.