This is an early and incomplete edition of the linkfest. Check in this weekend for more linky goodness.

Quote of the day

Eddy Elfenbein, “Successful investing basically boils down to buying high-quality companies at cheap prices.” (Crossing Wall Street)

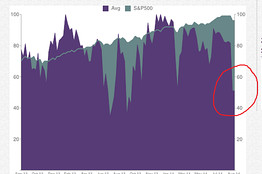

Chart of the day

Active managers are getting more cautious. (Focus on Funds)

Markets

Long rallies make us forget the realities of corrections. (Barry Ritholtz)

The case for a bottom in cotton. (See It Market)

A look at the recent hiccup in high yield bonds. (Aleph Blog, WSJ)

Everything is correlated except [fill in the blank]. (The Reformed Broker)

Median stock valuations are higher than they were in 2000. (Brett Arends)

Strategy

Losing stocks have one thing in common: high starting valuations. (Millennial Invest)

Investment advice doesn’t have to be complicated to be good. (A Wealth of Common Sense)

How to time the market like Warren Buffett. (The Felder Report)

Should you ignore “manager of the year” awards? (Larry Swedroe)

Companies

When open software wins. (Asymco)

Why Time Warner ($TWX) is going to get more aggressive online. (Quartz)

Global

Italy is in a depression. (Washington Post)

Does the distinction between emerging and frontier markets matter? (ETF)

Economy

The US economy is getting more sclerotic. (FiveThirtyEight)

Is this a better measure of labor utilization? (Bonddad Blog)

Robots

When humans become a luxury good. (Quartz)

Will you lose your job to a robot? (Marginal Revolution, The Upshot)

The transition to driverless cars is going to be tricky. (Tim Harford also WSJ)

Earlier on Abnormal Returns

What you might have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Seth Godin, “Don’t measure anything unless the data helps you make a better decision or change your actions.” (Seth Godin)

More on the goings on at StockTwits. (Howard Lindzon)

In praise of idleness (and vacations). (The Atlantic, Washington Post)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits and Twitter.