Quote of the day

Barry Ritholtz, “The legacy of these crashes stays with many folks for a long time. It colors everything they see for years.” (Bloomberg View)

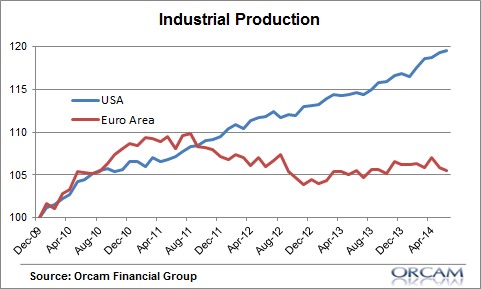

Chart of the day

The divergence in industrial production between the US and Europe is notable. (Pragmatic Capitalism)

Markets

Late cycle behavior continues to dominate. (Pension Partners)

Why you should think about fading ‘investment memes.’ (A Wealth of Common Sense)

Credit

Where are we in the credit cycle? (FT Alphaville)

What to make of the rise in credit spreads. (Dealbook)

Berkshire Hathaway ($BRKB)

Even Warren Buffett experiences drawdowns. (Ben Carlson)

7 reasons Warren Buffett is sitting on so much cash. (Brian Lund)

Should investors be worried when Berkshire stock is strongly outperforming? (Dan Lyons)

Strategy

Skilled daytraders are few and far between. (TraderFeed, ibid)

Some free online resources for investors. (Aleph Blog)

A primer on fund flows. (The Fat Pitch)

The truth about stocks sitting at their 52-week highs. (Alpha Architect)

How investors can do better than risk-parity. (SSRN)

Companies

What is Kinder Morgan’s ($KMI) new peer group? (SL Advisors)

Finance

Alibaba, amidst accounting issues, is sucking the air out of the IPO market. (WSJ, MoneyBeat)

Peer-to-peer loans are poised for further growth. (FRB of Cleveland)

Funds

Most investors don’t understand alternative investments. (Bloomberg)

Bank loan funds are no free lunch. (ETF)

Bitcoin

Why hasn’t Bitcoin taken off for retail transactions? (Dealbook)

The Winkelvii picked the right lawyer to get a Bitcoin ETF launched. (Bloomberg)

Economy

Industrial production rose in July. (Calculated Risk, Bonddad Blog)

Rising home prices are putting the global economy at risk. (Quartz)

Earlier on Abnormal Returns

What you might have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

On the sad devolution of Discovery Channel ($DISCA). (Quartz)

Being a music curator for online services is now a real job. (FT)

Need wi-fi? Go to a McDonald’s ($MCD). (Quartz)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Tumbler and Twitter.