This is a very early edition of the Sunday linkfest. We will catch back up after the Labor Day holiday.

Quote of the day

Morgan Housel, “(T)here’s a simple answer to all the stories you hear about investors not trusting the market: the market isn’t the problem. You, and your expectations, are the problem. You are your own worst enemy.” (Motley Fool)

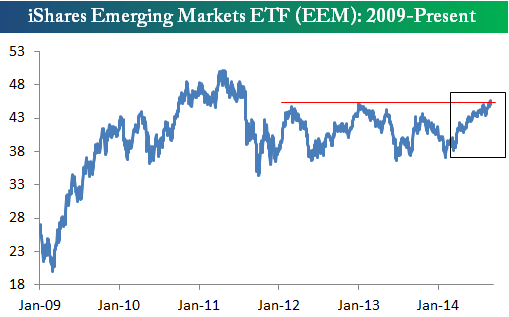

Chart of the day

Emerging markets are breaking out. (Bespoke)

Strategy

Maybe this whole indexing thing has gone too far. (Aaron Task)

Why the stock market feels riskier after a fall. (A Wealth of Common Sense)

Parsing Burton Malkiel’s latest investing advice. (Morningstar)

What does a global passive benchmark look like? (GestaltU)

“Is corporate political spending bad for investors?” (Jason Zweig)

Barry Ritholtz talks with James O’Shaughnessy author of What Works on Wall Street: A Guide to the Best-Performing Investment Strategies of All Time. (Big Picture)

Psychology

Why you need to seek out contradictory opinions. (Vitaily Katenelson)

How to develop intuition in trading. (Adam Grimes)

Economy

A look back at the economic week that was. (Bonddad Blog, Big Picture)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

What you might have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Where the “rental economy” is working and where it is not. (NYTimes)

The summer movie box office has been awful. (Time)

Laptops were not optimized for ergonomics. Does the Kickflip solve that problem? (AppleInsider)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Tumblr and Twitter.