Quote of the day

Jesse Felder, “Investment advice like this should be compensated just like all the other “advice” given by professionals out there – attorneys, accountants, therapists, etc. – on an hourly rate.” (The Felder Report)

Chart of the day

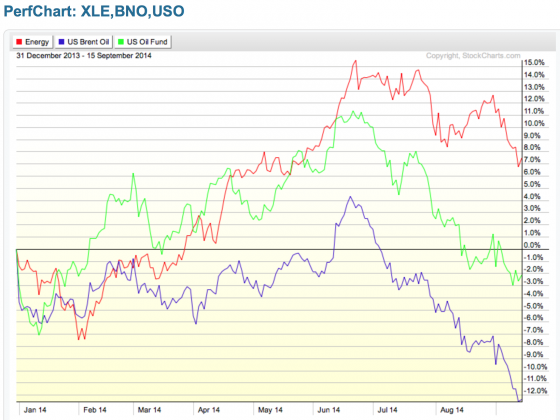

Brent oil price weakness is notable. (FT Alphaville)

Markets

Small caps continue to lag. (Crossing Wall Street, ibid)

Where did all the “deep value” stocks go? (Millennial Invest)

Just how much is the big buyback wave driving stocks higher? (WSJ, The Reformed Broker)

Why you should think twice (or three times) about buying Alibaba ($BABA). (Jason Zweig)

Strategy

Why relying on past market returns is a big mistake. (Pragmatic Capitalism)

Many managers have a “not in invented here” problem. (BeyondProxy)

Investors often willfully ignore the facts. (Bucks Blog)

Trading

How to cultivate trading intuition. (TraderFeed)

It’s not enough to find “excellent reward/risk ratio trades.” (Adam Grimes)

Companies

Eddie Lampert is loaning money to Sears Holdings ($SHLD). (Fortune, Bloomberg)

Would regulators really let AB InBev ($BUD) and SABMiller combine? (Wonkblog)

California

Calpers is shutting down its hedge fund investing. (Bloomberg, Barry Ritholtz, Pragmatic Capitalism, FT Alphaville, Dealbook)

The Univ. of California is launching a fund to invest in university-related startups. (WSJ)

Finance

A theory on why defined benefit plans went away. (WSJ)

Who wants to be in charge of Harvard’s endowment fund? (Dealbook)

The big flaw in share buybacks. (Economist)

ETFs

Thinking about bank loan funds as illiquid junk bond funds. (Newfound Research)

Economy

The outcome of the FOMC meeting is genuinely in doubt. (Gavyn Davies)

Earlier on Abnormal Returns

Is this the beginning of the end of the hedge fund gravy train? (Abnormal Returns)

What you might have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Valuations can be fixed, but burning cash is irreversible. (A VC)

Why embracing failure is tougher than it looks for companies. (FT)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.