Quote of the day

Joe Fahmy, “Remember that the market is a master manipulator. It conditions us to think one way over and over and over until we are finally convinced of a pattern. Just when we think we have things figured out, the market magically changes character.” (Joe Fahmy)

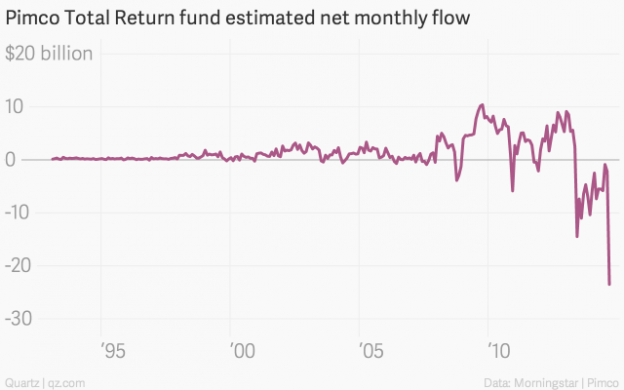

Chart of the day

The story of Pimco Total Return Fund in asset flows. (Quartz)

Markets

Why you should expect a pick up in equity market volatility. (Pension Partners)

S&P 500 dividends rose 12%+ in Q3. (Crossing Wall Street)

Strategy

Why the yield curve matters. (The Reformed Broker)

How have bonds performed during periods of rising rates? (Sellwood Consulting)

We are all foreasters, get over it. (Pragmatic Capitalism)

Companies

Warren Buffett is getting into the car retailing business. (Fortune, MoneyBeat)

Cable companies are getting out of the TV business. (WSJ)

Netflix ($NFLX) is getting into the Adam Sandler business with a four-film deal. (NYTimes)

Finance

Key man risk is a real thing in investment management. (Reuters)

Josh and Barry have joined the robo-advisor fray. (Business Insider, Wealth Management, InvestmentNews)

What Google ($GOOG) should keep in mind as it wades into fintech. (ETF)

On the battle between New York and London for financial supremacy. (FT)

Why do people in finance get paid so much? Is it the stress? (Noah Smith, WSO)

ETFs

The October Mutual Fund Observer with an overview of the most recent Morningstar ETF conference. (Mutual Fund Observer)

Investors are parking their Pimco redemptions in bond ETFs. (MoneyBeat)

There are no shortage of dividend-focused ETFs. (Institutional Investor)

The problem of illiquid bonds in liquid bond ETFs. (Aleph Blog)

Global

Now wealthy Indians are buying homes in the US. (NYTimes)

Economy

Weekly initial unemployment claims are near post-crisis lows. (Calculated Risk, Capital Spectator)

Why we should expect to see continued nominal wage growth. (Bonddad Blog)

Many Fed haters can’t admit they were wrong. (Joe Weisenthal)

On the problem of false precision in finance and economics. (Mark Buchanan)

Earlier on Abnormal Returns

The books Abnormal Returns readers purchased in September. (Abnormal Returns)

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

In praise of single-purpose tools. (Craig Mod)

How to complain less. (Becoming Minimalist via @barbariancapital)

America is overlooking the energy value in manure. (Daniel Gross)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.