Quote of the day

Morgan Housel, “Realizing the limits of your intelligence one of the most important skills in finance.” (Motley Fool)

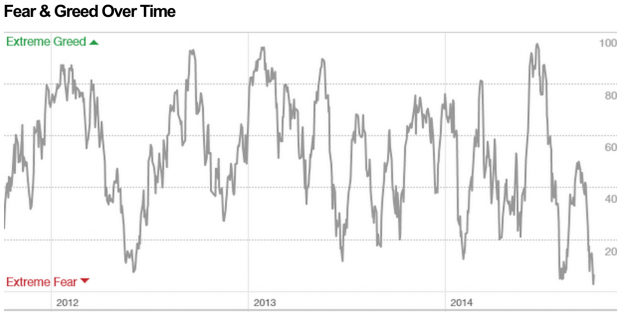

Chart of the day

Some measures of market sentiment are finally demonstrating some fear. (CNN via Ryan Detrick)

Strategy

Jeff Miller, “If you are stuck in gold or out of the market completely, you might want to reconsider your approach.” (A Dash of Insight)

To win big in the stock market you not only have to pick a rocket ship you also have to hold on for dear life. (Barry Ritholtz)

Tim Harford, “We passive investors like to congratulate ourselves on avoiding those parasites, the active fund managers, who charge high fees without delivering high returns. Yet we are parasites too, waiting for others to pay for research and then following the herd.” (FT)

Funds

Felix Salmon, “People who understand the bond market understand that making money in bonds is hard, and has very little to do with your big macro theses, or what you write in your newsletters.” (Medium)

Why didn’t Bill Gross simply retire? (Barron’s)

Why you won’t find star managers in the world of mutual funds any more. (Michael Santoli)

Companies

Why shorting GoPro ($GPRO) is so expensive. (MoneyBeat)

Are electric cars going to save the big utilities? (Economist)

Finance

Charles Schwab ($SCHW) is readying its own (free) robo-advisor. (Reuters, Business Insider)

ETFs

Are ETFs the cause or the effect of bad investor behavior? (ThinkAdvisor)

Managed ETF accounts have not been a boon for investors. (Barron’s)

Economy

The “dental indicator” is pointing toward a weaker economy. (Businessweek)

How close are US labor markets to normalization? (Sober Look also Econbrowser)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What you might have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Why Costco ($COST) gives away free samples. (The Atlantic)

22 big thinkers everyone should follow on Twitter. (Business Insider)

YouTube has a problem: the site doesn’t have good cadence. (Hunter Walk)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.