Quote of the day

James Surowiecki, “The situation [Netflix] is an unusually stark example of competitive capitalism in action: someone invents a new market and thrives, but the success shows competitors just how lucrative the market can be.” (New Yorker)

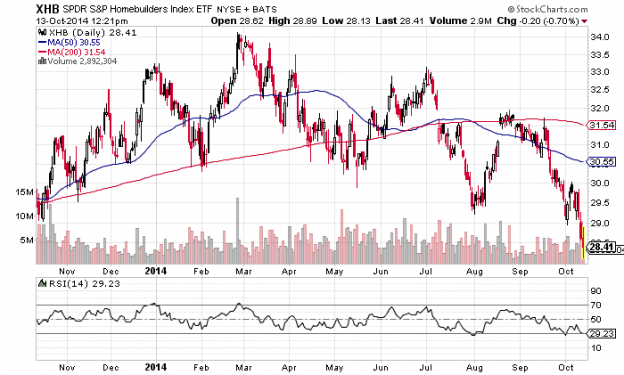

Chart of the day

Homebuilders are sitting at 52-week lows. (StockCharts Blog)

Markets

The $VIX has doubled since mid-Summer. (Capital Spectator, See It Market)

Traders are pushing their bets on the surging US dollar. (MoneyBeat, Crossing Wall Street)

Some signs of a short-term oversold market. (Short Side of Long)

Risk-off sector behavior is somewhat predictable. (Adam Grimes)

Markets are reacting to slower global growth. (Humble Student)

Adjusting to a new Fed policy regime is not going to happen overnight. (Market Anthropology)

Strategy

Why stock markets crash. (Macrofugue)

Stock markets decline. Get used to it. (A Wealth of Common Sense)

Companies

On the (healthy) state of Corporate America. (Bloomberg)

Has the buyback boom been a waste? (FT)

What is data actually worth? (WSJ)

Bill Ackman

Permanent capital for Bill Ackman’s new fund is now available at a discount. (Dealbook, MoneyBeat, Bloomberg, FT)

Canadian Pacific ($CP) and CSX ($CSX) are talking consolidation. (WSJ, Dealbook, MoneyBeat)

Finance

Buyside bond traders are more important in a world of shrinking liquidity. (WSJ)

On the downside of cut-rate hedge funds. (FT)

ETFs

Janus Group ($JNS) is buying its way into the ETP game. (ETF)

Big asset managers are waiting for the SEC to weigh in on non-transparent ETFs. (InvestmentNews)

Access to Schwab’s ($SCHW) ETF OneSource comes at a high price to issuers. (RIABiz via @mebfaber)

Global

Global growth is slowing but not headed for a recession. (Gavyn Davies)

The “most important chart in the world” is flashing a warning. (Telegraph)

Economy

At what point to lower oil prices begin to pinch frackers. (Econbrowser)

Why a future return to the zero bound is likely. (Tim Duy)

Why Jean Tirole won the 2014 Nobel Prize in Economics. (Marginal Revolution, Digitopoly, Real Time Economics)

Earlier on Abnormal Returns

Happy ninth blogiversary to me. (Abnormal Returns)

What you might have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

Heavier babies do better in school. (NYTimes)

The worst of both worlds: student debt and no degree. (WSJ)

Eric Schmidt’s new book How Google Works talks about the power of “combinatorial innovation.” (Farnam Street)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.