Quote of the day

Mark Dow, “The irony of the precious metals bubble is that it was the guys yelling ‘bubble’, bubbles of every stripe—bond, stock, credit—who sought refuge in the only asset class that was truly in a bubble.” (Behavioral Macro)

Chart of the day

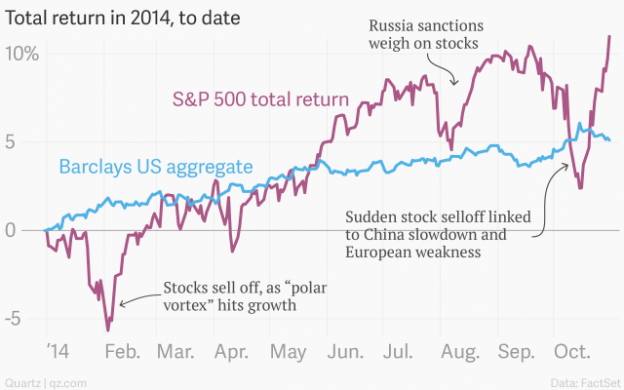

Remember when bonds were leading stocks YTD? (Quartz)

Strategy

History is on the side of the stock market for the next six months. (Quantifiable Edges)

A lot can go wrong when you are forecasting 10-year asset class returns. (A Wealth of Common Sense)

Factor investing in the corporate bond market. (SSRN)

Muni bonds

2014 has been the best of all worlds for muni bonds. (WSJ)

Muni bond investors can earn a liquidity premium. (Larry Swedroe)

Finance

Hedge funds want in on the peer-to-peer lending market. (FT)

John Malone is the king of tax maneuvering. (Bloomberg)

Funds

Robo-advisors are going to expand the audience for portfolio management services. (Matt Hougan)

First Trust is on a roll. (ETF)

Global

If you are investing in Japanese stocks be very aware of the currency situation. (Market Anthropology)

Why the head of Norway’s sovereign wealth fund is focused on China. (Bloomberg)

Globalization is not accelerating all that much. (Justin Fox)

If 1% of Chinese farmers plant coffee…. (FT)

Economy

The October ISM manufacturing report points towards more growth. (Crossing Wall Street)

First-time home buyers are still pretty scarce. (Real Time Economics)

An evaluation of quantitative easing. (Econbrowser)

Grain is getting backed up due to rail car shortages. (WSJ)

Earlier on Abnormal Returns

What books Abnormal Returns readers purchased in October 2014. (Abnormal Returns)

What you might have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

Twitter ($TWTR) is not a replacement for blogs. (Marco Ament)

How one man uses Twitter to augment his damaged memory. (Fast Company)

Some of today’s biggest tech names aren’t old enough to remember the Internet bubble. (WSJ)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.