Quote of the day

Peter Munk, chairman of Barrick Gold ($ABX), “I really have no ability to forecast gold prices. I have been in the business for 30 years, and it occupies my mind day and night.” (Bloomberg)

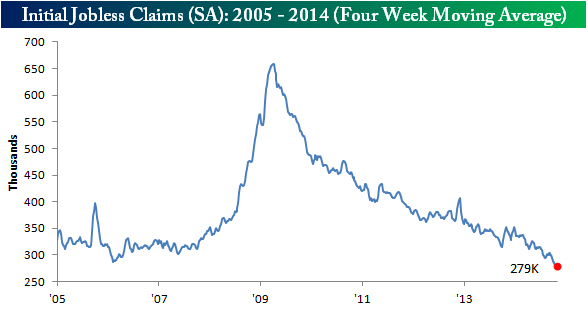

Chart of the day

Weekly initial unemployment claims are at millennium lows. (Bespoke also Calculated Risk)

Markets

Utilities did what they were supposed to in October. (Dragonfly Capital)

Momentum has worked pretty well in the UK. (UK Stock Market Almanac via @WholeStreetRT)

You could not have made money in trendfollowing this year if you had given up. (FT)

Commodities

In case you weren’t convinced that precious metals were oversold. (The Short Side of Long)

Why is lumber going nowhere? (StockCharts Blog)

It is going to take some time before you see higher oil prices. (Yahoo Finance)

Strategy

There is always an excuse for NOT investing. (Irrelevant Investor)

Simulating market return is no simple task. (Aleph Blog)

How the “momentum gap” can help explain the timing of momentum returns. (Alpha Architect)

How concentrated should you make your value portfolio? (Millennial Money)

A Q&A with Patrick O’Shaughnessy author of Millennial Money: How Young Investors Can Build a Fortune . (The Guardian)

Skilled investors

The three skills you need to become a “bond king” or the like. (A Wealth of Common Sense)

More skilled investors can offset periods of bad luck. (Beyond Proxy)

Peak performers “keep getting better at getting better.” (TraderFeed)

Companies

Why the aluminum-bodied Ford ($F) F-150 is a game-changer. (Economist)

Beards have put the hurt on the business of shaving. (Wonkblog)

Technology

Twitter ($TWTR) is at-risk of losing the goodwill it built with Vine. (GigaOM)

AOL ($AOL) is “really just an ad company.” (Recode)

Can Yahoo ($YHOO) make still make smart acquisitions? (Eric Jackson)

Alibaba ($BABA) joins the crowd downplaying the cost of equity compensation. (Michael Santoli)

Microsoft ($MSFT) Office is free now free on mobile. (Reuters, Digits, Six Colors, The Verge)

Finance

Under what circumstances is cash on the balance sheet valued by markets at less than its worth? (CFO via @researchpuzzler)

“Banks and commodity trading firms are fundamentally different.” (Streetwise Professor via FT Alphaville)

ETFs

Why managers keep struggling ETFs open, you never know when they will catch fire. (ETF)

The Cambria Global Momentum ETF ($GMOM) is now live. (ETF Trends)

Earlier on Abnormal Returns

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

How to use universities to rebuild cities. (Fortune)

What are kids missing by finishing a bachelor’s degree in three years? (WSJ)

What can you do with a degree with an arts? (The Atlantic)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.