Quote of the day

Charles Bilello, “The psychology of the market is slowly changing, reverting back to a more typical environment where investors care about earnings, revenues, and potential fraud in individual stocks” (Charlies Billelo)

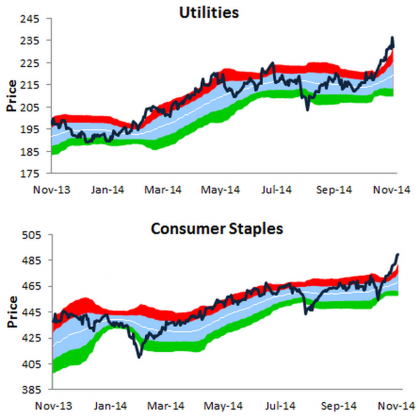

Chart of the day

Utilities and consumer staples are overbought. (Bespoke)

Strategy

Noes from the 2014 For Kids Chicago conference. (Market Folly)

Why you should try and eliminate as much noise as possible. (A Wealth of Common Sense)

Why it is impossible to beat the stock market “forever.” (Enterprising Investor)

Static factors or fixed factors: the argument against ‘smart beta.’ (SSRN)

Companies

A profile of Dick Costolo, CEO of Twitter ($TWTR), at a crossroads. (WSJ)

Why David Einhorn is skeptical about Amazon ($AMZN). (Bloomberg View)

Dustin Curtis, “Amazon’s retail strategy of being allergic to profit does not translate well into hardware manufacturing.” (Dustin Curtis)

ETFs

Eaton Vance ($EV) gets approval from the SEC for nontransparent ETFs. (WSJ, ETF)

Russia

The Russian stock market wants to keep going down. (All Star Charts)

As does the Russian Rouble. (FT Alphaville)

Economy

The October non-farms payroll numbers show continued growth. (Calculated Risk)

Canada’s jobless rate has dropped to pre-crisis levels. (Globe and Mail)

Earlier on Abnormal Returns

Podcast Friday on how ubiquitous technologies change everything. (Abnormal Returns)

What you might have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Morgan Stanley ($MS) employees can now get reimbursed for Uber rides. (Bloomberg)

How Mark Zuckerberg, CEO of Facebook ($FB) combats decision fatigue. (TheStreet)

Apple’s ($AAPL) iTunes is a bloated mess. (MacWorld)

Support Abnormal Returns by visiting Amazon, signing up for our daily e-mail or following us on StockTwits, Yahoo Finance and Twitter.