Book review: Three kinds of readers that will benefit from reading Patrick O’Shaughnessy’s Millennial Money: How Young Investors Can Build a Fortune. (Enterprising Investor)

Quote of the Day

"What feels safe is often risky, and what feels risky is often safe. This statement contradicts just about every evolutionary instinct we possess. We tend to seek out safety and avoid risk whenever possible."

(Carl Richards)

Chart of the Day

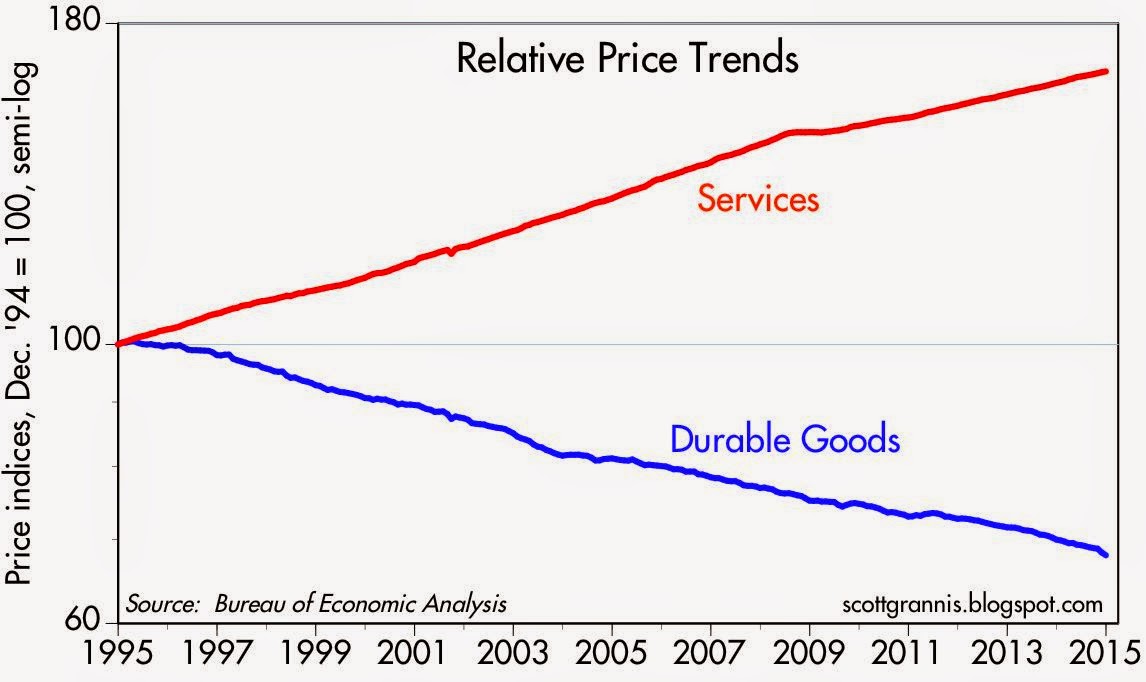

A tale of the tape: two decades of price trends for services and durable goods.

Strategy

- Most of the time the stock market does a whole lot of nothing. (crossingwallstreet.com)

- A real-life example of the equity market crushing hedge funds. (fortune.com)

Companies

- Google ($GOOG) and Uber are going head-to-head in the race to driverless cars on demand. (bloomberg.com)

- What VMWare ($VMW) is doing to get with the Cloud. (businessinsider.com)

- Just how much does Amazon ($AMZN) Prime add (or detract) from the company's bottom line? (fortune.com)

- Apple ($AAPL) sells experiences not phones. (aboveavalon.com)

Finance

- S&P settles with the government to put the financial crisis in the rear view mirror. (dealbook.nytimes.com)

- What is an "eBond" and how could it change the corporate bond market? (bloomberg.com)

- Short-term Nestle bonds now trade with a negative yield. (ft.com)

Funds

- Don't write off active management until after the next bear market. (thinkadvisor.com)

- Robo-advisors want to disrupt ETFs by directly investing. (etfdb.com)

- State Street ($STT) is cutting fees on a big chunk of its ETF lineup. (blogs.barrons.com)

Global

- Australia is the latest country to cut rates to fight fears of deflation. (wsj.com)

- German companies are scrambling to get enough women on their boards. (bloomberg.com)

Economy

Earlier on Abnormal Returns

- Check out a Q&A with me on the topic of investment blogging. (equities.com)

- Startup links: the business of disruption. (abnormalreturns.com)

- What you may have missed in our Monday linkfest. (abnormalreturns.com)