It has become an annual tradition here to note the release of Credit Suisse’s latest annual global investment returns yearbook. It is a great reference source and I used some of the data in an earlier version of that publication to help me write my own book. Well it is that time of year again and the new Credit Suisse Global Investment Returns Yearbook 2015 is now out. Dimson, Marsh and Staunton, the authors of the yearbook are also the authors of the much cited Triumph of the Optimists: 101 Years of Global Investment Returns.

In addition to their annual look at returns across a number of countries and time frames the authors take an in-depth look at three topics all of which are worth an in-depth look:

- The importance of industry weightings on long-run returns;

- The role of social responsibility in investing and

- The existence of an equilibrium discount rate.

Speaking of industries (#1) the authors go into a great deal of depth on the historical importance of industries in investing. They show both in the US and UK how the sector concentrations have changed, often dramatically, over time. They also note how especially in emerging markets you can end up with significant concentrations in a single industry.

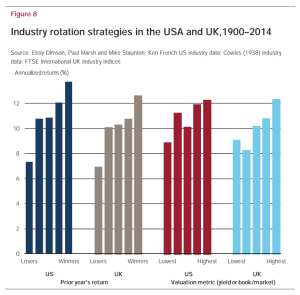

From an investment perspective they also show that two common factors, momentum and value, can help investors in making sector allocation decisions. Dimson, Marsh and Staunton discuss why there might be a value effect at the industry level.

Source: Credit Suisse Global Investment Returns Yearbook 2015

There is a reason why I recommend everyone download (and read) this document. Not only is it free but it provides both novice and experienced investors with some perspective on some very basic issues. For example, the next time some one says you should divest your portfolio of so-called “sin stocks” you can say….

Some other posts that mention the yearbook:

Why sector allocation matter a lot.

The logic behind the outperformance of so-called ‘sin stocks.’