Wednesday is all about personal finance here at Abnormal Returns. You can check out last week’s links including how to align your values with your finances.

Quote of the Day

"Vanguard is right to think investors need help."

(Julie Segal)

Chart of the Day

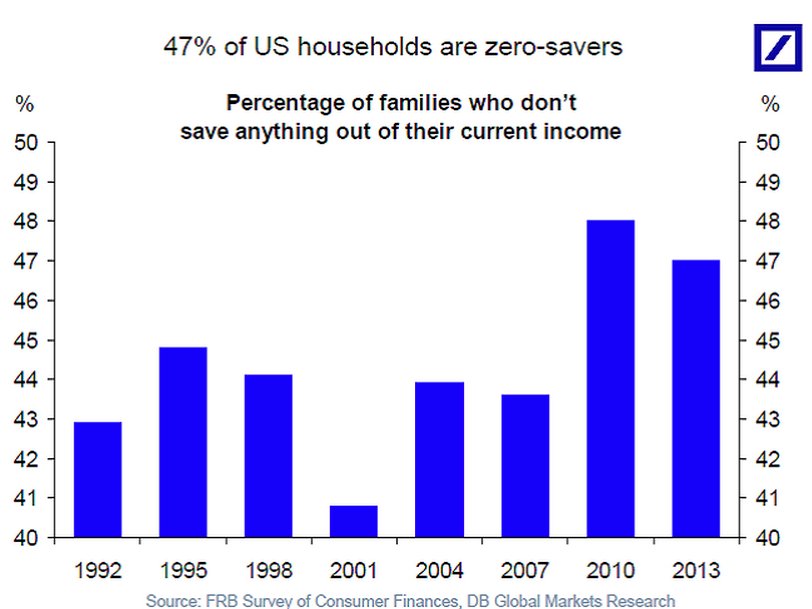

Nearly half of Americans are not saving anything for retirement.

Personal finance links

- Competition is coming to the student loan business. (washingtonpost.com)

- Three simple money rules for Millennials. (vanguardblog.com)

- The pros and cons of the 30-year fixed rate mortgage. (awealthofcommonsense.com)

- Some retirees choose to upsize later in life. (fa-mag.com)

- How judgment got flushed from the financial system. (bankers-anonymous.com)

Investing

- Why you need to temper your long-term expectations for bonds. (canadiancouchpotato.com)

- A closer look at the government's Thrift Savings Plan. (awealthofcommonsense.com)

- RIP, Sheldon Jacobs, one of the few purveyors of simple investing advice. (marketwatch.com)

Robo-advisors

- Three ways robo-advisors are changing the financial advisory industry. (thinkadvisor.com)

- Do you even need a robo-advisor? (fusion.net)

- Why an algorithm can give better advice. (etf.com)

- Takeaways from the LearnVest-Northwestern Mutual deal. (kitces.com)

- Bookmark for future reference: a robo-advisor scorecard. (investorhome.com)

Financial advisors

- Should we treat financial advisors like doctors? (pragcap.com)

- When it makes sense to pay for financial advice. (nytimes.com)

- Do young investors need a financial advisor? (awealthofcommonsense.com)

- How a solo RIA went from $0 to $74 million in assets with an unusual strategy. (riabiz.com)

- How the UK is ahead of the US when it comes to fiduciary standards. (etf.com)