Tuesdays at Abnormal Returns are all about startup and venture capital links. You can check out last week’s links including a look at the confusion over convertible notes.

Chart of the Day

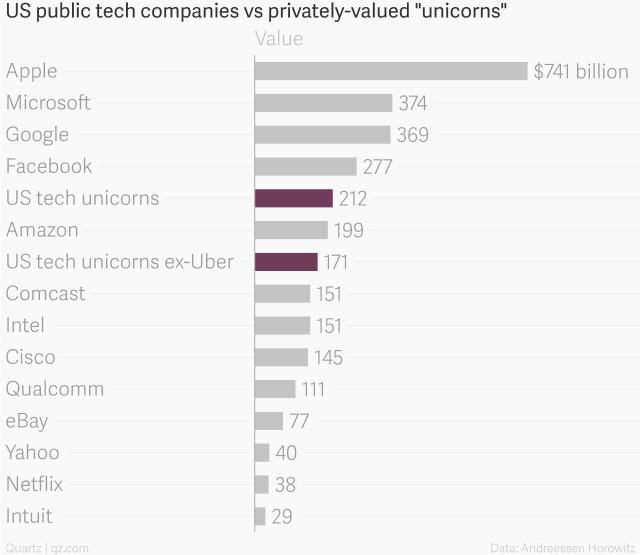

America’s tech unicorns are still in total valued less then Facebook ($FB).

Venture capital

- US tech funding: what the heck is going on. (a16z.com)

- Not every investment is a home run, breaking down the return on VC funds. (cdixon.org)

- Four options so-called unicorns have to break their dependence on private capital. (techcrunch.com)

- The longer a company stays private the greater the need for secondary liquidity for employees. (ft.com)

- Why complexity serves investors in private companies. (aswathdamodaran.blogspot.co.uk)

- Six reasons not to invest in a venture capital fund. (thisisgoingtobebig.com)

- A slew of startups are being formed to increase employee happiness. (washingtonpost.com)

- Pinterest is adding 'buy buttons' to advance monetization. (wsj.com)

- States are taking the lead on crowdfunding. (nytimes.com)

- How "Silicon Valley" affects the real thing and vice versa. (fortune.com)

Founders

- One thing every founder should know about convertible notes. (bothsidesofthetable.com)

- The startup founder myth has gone too far. (washingtonpost.com)

- Founders should pledge these five things when taking venture capital. (blog.semilshah.com)

- Some thoughts on how startups can effectively use lawyers. (blog.theskimm.com)

- Why startups should be wary of too much profitability, too soon. (hbr.org)

- When should you leave your job to start a company? (joshmaher.net)