Anyone who has gotten past Finance 101 recognizes the central role that the risk-free rate plays in finance and investing. While there is some disagreement as to what rate is THE risk-free rate it goes without saying that the risk-free affects all manner of decisions.

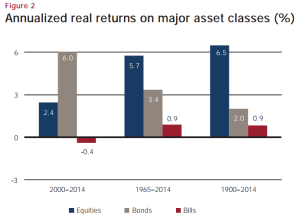

If you assume the 3-month Treasury bill as the risk-free rate then you can see a big change in the returns over time. The chart below shows the real returns on cash, bonds and equities in the US since 1900. However since the year 2000 you can see that the return on cash has been negative on a real basis. The question is whether this is simply a blip or whether it represents some sort of new normal.

Source: Credit Suisse Global Investment Returns Yearbook 2015

That is why the current debate over the very nature of the risk-free rate is so interesting. Some believe, like Paul Gebhardt does, that the risk-free rate, and rates in general are headed asymptotically towards zero due to the accelerated pace and low cost of technological innovation. This has a number of implications but in regards to interest rates he writes:

It was never cheaper to innovate or to start a business and the result is a rapid increase in the supply of capital. Corporations are pilling massive amounts of cash. Non-financial US companies alone had more than $1 trillion in cash on their balance sheets end of 2014…The causality is simple: A lower demand for capital means higher supply, which causes lower returns.

Others argue like Cullen Roche at Pragmatic Capitalism that in order for the economy and banking system to operate money should in fact generate a return. He writes:

So, money is a financial asset that bears various forms of risk warranting a return. And the appropriate benchmark rate of interest is one that does not harm the banking system, but also does not contribute to economic stagnancy…So, the short answer to the above question is yes, money should earn interest.

The extraordinary role the Fed, and other central banks, have played during this cycle is affecting how we think about the risk-free rate. But as Ben Carlson at A Wealth of Common Sense notes there are good arguments to be made that historically savers were too richly rewarded for not taking on risk. While there are still more questions to be answered than not, Carlson writes:

If the U.S. has the biggest, safest financial markets in the world, why should investors expect to earn a high return on their cash? People seem to assume that there’s a long-term equilibrium risk-free interest rate that should allow them to earn 4-5% on their cash savings. Should they? What if those rate levels are a thing of the past?

This cycle has favored those investors who took on risk, whether it be in the equity markets or farther out the maturity scale of fixed income. So much so that the prospective return on a 60/40 portfolio is at one of its lowest levels in quite some time. This may be due to investors recognizing the real negative returns available on short-term risk-free instruments.

Saying anything definitively about where the risk-free rate should be, or where it is headed, is a tough proposition. All the more so because recent history so colors our thinking. The debate over the risk-free is not a theoretical one. It has real implications for all manner of markets and investment decision making. If you can tell us where the risk-free rate is headed (and why) you have a big jump on the competition.