Book review: Why family business succession fails. A look at Myths and Mortals: Family Business Leadership and Succession Planning by Andrew Keyt. (FT)

Quote of the Day

"The smart investor that wants to succeed should focus on achieving absolute returns using a sensible strategy across a full market cycle that includes both bear and bull markets rather than comparing themselves to their peers."

(David Varadi)

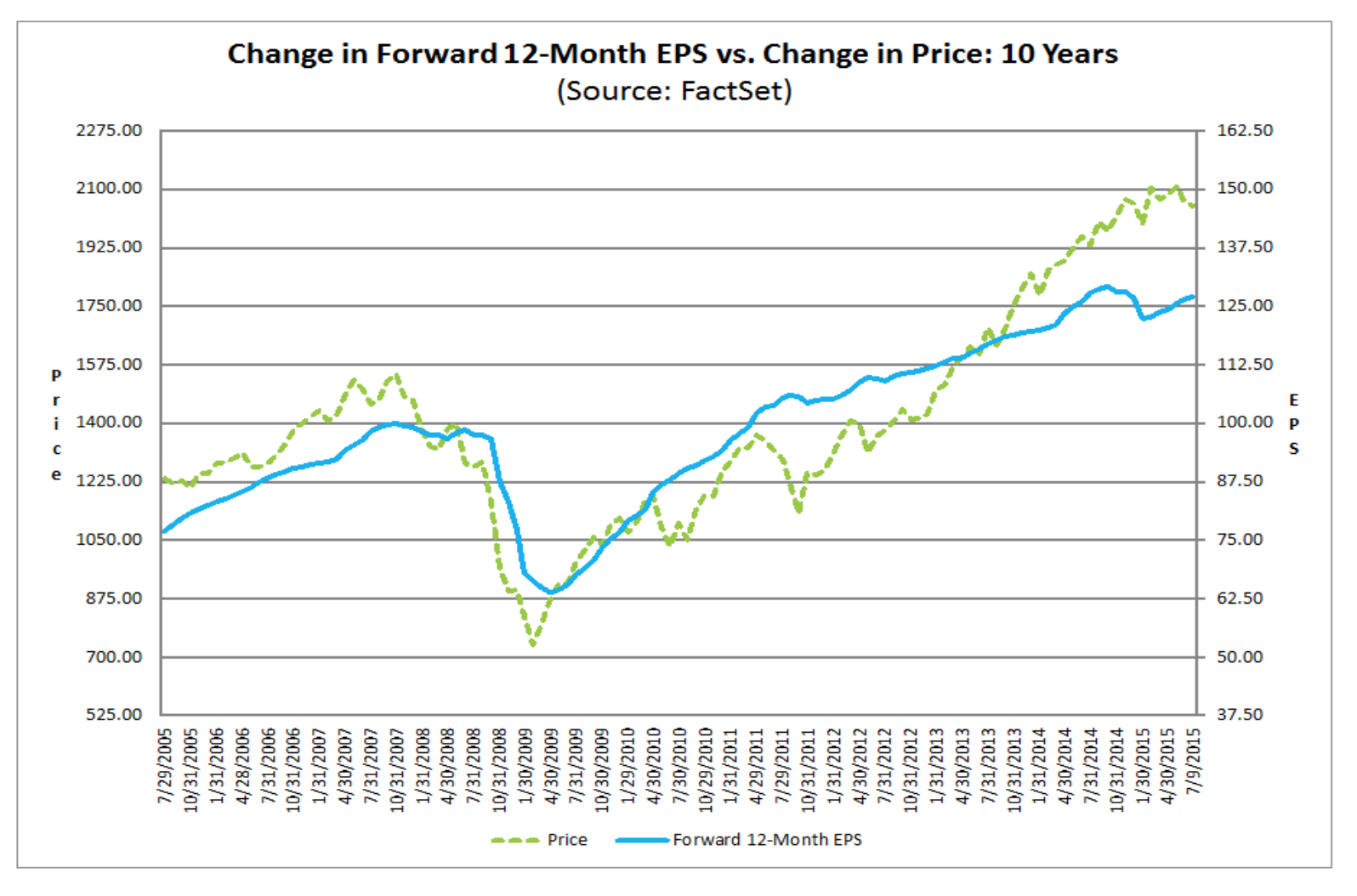

Chart of the Day

Want to know where stocks are going? Figure out the change in 12-month forward earnings estimates. (via @ritholtz)

Markets

- A visual report of a bunch of (failed) stock market crash calls. (fundreference.com)

- Money managers are feeling less bearish about gold. (marketwatch.com)

Strategy

- Three down years? Buy. (mebfaber.com)

- Try and let market volatility work in your favor when trading. (thealephblog.tumblr.com)

Companies

- There is a shale oil-related M&A boom out there waiting. (thestreet.com)

- Prime Day turned out to be a big deal for Amazon ($AMZN). (washingtonpost.com)

- A comment from Google ($GOOG) got Etsy ($ETSY) stock moving. (businessinsider.com)

ETFs

- Ignore the role of luck in fund management at your own risk. (awealthofcommonsense.com)

- Why the Russell 2000 index has negative alpha. (etf.com)

Economy

- A dozen interesting economic charts. (scottgrannis.blogspot.com)

- Some slight signs of inflation are appearing in CPI. (crossingwallstreet.com)

- Copper prices predict a whole lot of nothing. (valueplays.net)

- America is measuring productivity wrong (and understating it). (wsj.com)

- Multi-family construction creates fewer jobs than single-family homes. (bloomberg.com)

Earlier on Abnormal Returns

- Podcast links: small tweaks, big effects. (abnormalreturns.com)

- What you may have missed in our Thursday linkfest. (abnormalreturns.com)