I thought this tweet by Benedict Evans of Andreessen Horowitz was particularly insightful:

Pretty soon saying ‘touch’ screen, ‘mobile’ internet or ‘self-driving’ cars will be like saying ‘colour’ TV. What was new becomes a given.

— Benedict Evans (@BenedictEvans) September 22, 2015

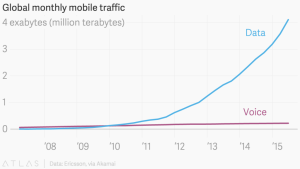

This idea was reflected also in a short post by Dan Frommer at Quartz who asks ‘why are we still calling them phones’ when they are used primarily as hand-held computers. The chart below shows the growing gap between data use and voice:

Source: Quartz

Which begs the question: what investment (or finance) term will we soon think of as antiquated? I can think of a couple of examples off the top of my head.

- Robo-advisor: there is an inordinate amount of press about robo-advisors, including on this site. My guess is that the term will fall by the wayside as automated portfolio management solutions, by whatever name, become the dominate way of managing money.

- Active vs. passive: terms like smart beta are already passé as ‘smart beta 2.0‘ catches a bid. However the active vs. passive distinction has already lost its relevance. Cullen Roche at Pragmatic Capitalism is all over this false premise.

- Commission: this one is a bit more speculative. The success of Robinhood shows there is a huge demand for $0 commission stock trades. It seems that over time, the proper application of technology should bring down the cost of commissions.

It may be a cliché to say that the world is changing at an increasingly accelerating rate, but it is. Along the way that means certain terms will lose their caché. Oh well, time moves on whether we like it or not.