Monday is all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at the challenge of allocating across factors.

Quote of the Day

"Investing in commodity futures is not the same as investing in equities tied to commodities."

(Wes Gray)

Chart of the Day

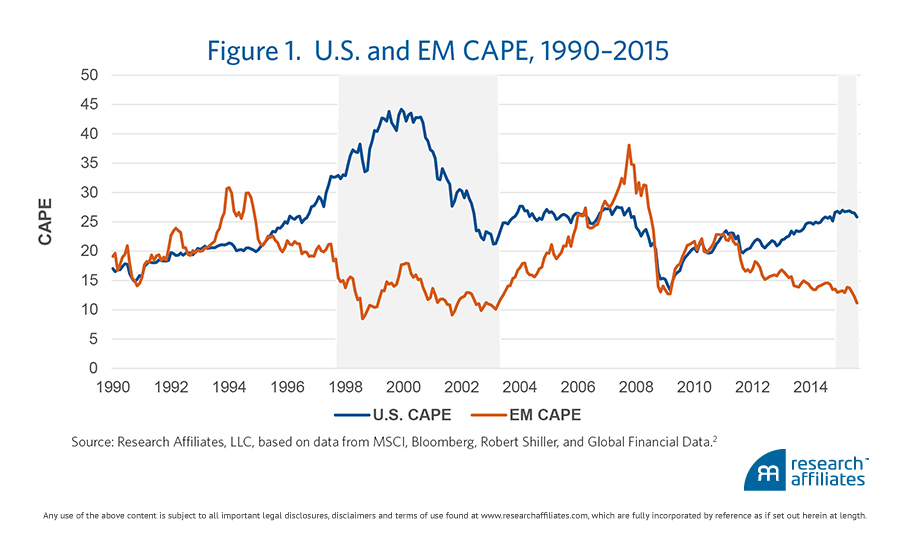

The valuation spread between the US and emerging markets is marked.

Research links

- Why commodities are not as attractive a portfolio diversifier as earlier thought. (news.morningstar.com)

- How do dividend paying stocks affect the value anomaly? (blog.alphaarchitect.com)

- Can combining value and momentum create better returns? (papers.ssrn.com)

- Momentum investing and asset allocation. (papers.ssrn.com)

- On the use of random portfolios to test asset allocation strategies. (capitalspectator.com)

- Should you try and optimize your seasonal strategy? (cxoadvisory.com)

- Why you should avoid water cooler investment advice. (etf.com)

- How to be a quant. (turingfinance.com)