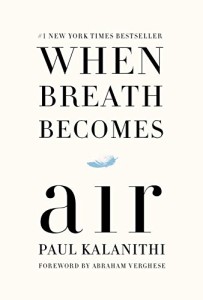

Readers continued to purchase Meb Faber’s new book Invest With the House: Hacking the Top Hedge Funds. However on the non-finance front When Breath Becomes Air by Paul Kalanithi really grabbed readers attention. Readers also continued to snap up The Term Sheet: A Startup Thriller Novel by Lucas Carlson.

Readers continued to purchase Meb Faber’s new book Invest With the House: Hacking the Top Hedge Funds. However on the non-finance front When Breath Becomes Air by Paul Kalanithi really grabbed readers attention. Readers also continued to snap up The Term Sheet: A Startup Thriller Novel by Lucas Carlson.

On the non-book front our readers continued to buy the Kindle Fire 7″ for just $49.99. On the high end readers also were attracted to the new Eero home wi-fi system that aims to eliminate dead wireless spots in your home.

For more book ideas you can check out our post compiling our many book links as well as last month’s top selling list. We present sales two ways: the first is by unit sales and the second way is by revenue which can be notably different. Here are the books (combined print and Kindle* that Abnormal Returns readers purchased at Amazon during February 2016:

The Top 10 (by Unit Sales)

- The Term Sheet: A Startup Thriller Novel by Lucas Carlson

- When Breath Becomes Air by Paul Kalanithi

- DIY Financial Advisor: A Simple Solution to Build and Protect Your Wealth by Wesley R. Gray, Jack R. Vogel, and David P. Foulke

- Invest With the House: Hacking the Top Hedge Funds by Meb Faber

- Adaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times – and Bad by Adam Butler, Michael Philbrick and Rodrigo Gordillo

- How to Make Your Money Last: The Indispensable Retirement Guide by Jane Bryant Quinn

- Quality Investing: Owning the best companies for the long term by Lawrence A. Cunningham, Torkell T. Eide and Patrick Hargreaves

- Abnormal Returns: Winning Strategies from the Frontlines of the Investment Blogosphere by Tadas Viskanta

- The Only Game in Town: Central Banks, Instability and Avoiding the Next Collapse by Mohamed El-Erian

- Originals: How Non-Conformists Move the World by Adam Grant

The Top 10 (by Revenue)

- When Breath Becomes Air by Paul Kalanithi

- Invest With the House: Hacking the Top Hedge Funds by Meb Faber

- Quality Investing: Owning the best companies for the long term by Lawrence A. Cunningham, Torkell T. Eide and Patrick Hargreaves

- How to Make Your Money Last: The Indispensable Retirement Guide by Jane Bryant Quinn

- DIY Financial Advisor: A Simple Solution to Build and Protect Your Wealth by Wesley R. Gray, Jack R. Vogel, and David P. Foulke

- Adaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times – and Bad by Adam Butler, Michael Philbrick and Rodrigo Gordillo

- Abnormal Returns: Winning Strategies from the Frontlines of the Investment Blogosphere by Tadas Viskanta

- The Only Game in Town: Central Banks, Instability and Avoiding the Next Collapse by Mohamed El-Erian

- The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War by Robert J. Gordon

- Originals: How Non-Conformists Move the World by Adam Grant

Thanks again to everyone who purchased a copy of my book or any other book (or item) during the month. Keep an eye on this space for more book news.