Hindsight bias, also known as the knew-it-all-along effect or creeping determinism, is the inclination, after an event has occurred, to see the event as having been predictable, despite there having been little or no objective basis for predicting it. (Wikipedia)

Hindsight bias is tricky for us humans/investors because it is so pervasive. Tim Richards at the Psy-Fi Blog writes:

Hindsight bias is virtually impossible to eradicate. It’s not something you can build defences against, learn new tricks and find ways of overcoming – it seems to be something absolutely fundamental to the whole human experience. Yet it can cause investor overconfidence in a very nasty way – if an investor continues to believe that they’re doing OK when they’re not then they won’t adjust their behaviour to improve.

Hindsight bias is one of the reasons that keeps investors from keeping and maintaining a well-diversified portfolio. Corey Hoffstein at the Newfound Research Blog writes:

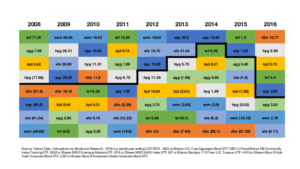

Viewed with the ben

efit of hindsight, diversification will always disappoint. To judge the outcome of diversification after the fog of uncertainty has lifted, however, misses the point: diversification provides us the incredibly important ability to admit we don’t know. We can be vaguely right instead of precisely wrong. Constant disappointment, then, might be the greatest indicator that we are well diversified.

One way to combat hindsight bias is to keep a diary. Keeping a diary is a common recommendation for traders and investors alike. Journals can be, as Richards notes, a reference for our future selves as we revisit earlier decisions. In the very least they provide us with the real-time decision points that led to a successful (or unsuccessful) investment.

Thinking big picture, journaling can be more than a guidepost to revisit from time to time. Journals can actually serve a loftier purpose. As Brett Steenbarger at Forbes writes:

Journaling is thinking aloud; it makes us conscious of our internal dialogues. In no small measure, journals are tools for mindfulness. They make us more self-aware and they make us more aware of our highest ideals. That is the most powerful reason of all for keeping a journal.

Julia Cameron author of The Artist’s Way and The Miracle of Morning Pages has been an advocate for what she calls “Morning Pages” for some time now. Morning pages are a ritual by which you write out early in the morning three pages of whatever crosses your mind at the time. Adherents to Morning Pages are quite vocal in their support. Oliver Burkeman at The Guardian writes:

Perhaps I shouldn’t have been surprised at how powerful Morning Pages proved, from day one, at calming anxieties, producing insights and resolving dilemmas. After all, the psychological benefits of externalising thoughts via journalling are well-established. And that bleary-eyed morning time has been shown to be associated with more creative thinking: with the brain’s inhibitory processes still weak, “A-ha!” moments come more readily.

In short we cannot become better investors, writers or people without some conscious process to make the internal external. Investing, including diversification, is by its nature a disappointment machine. There is always something to regret in hindsight. The challenge therefore is to use journals to help us learn from our past and then safely leave the past there where it belongs.