This month was light on book-related posts but there was no shortage of links. You can also check out the previous edition of this linkfest, or our latest monthly post (May) of the most popular books among Abnormal Returns readers. Remember anything you buy from Amazon through these links goes to support the site. Enjoy!

This month was light on book-related posts but there was no shortage of links. You can also check out the previous edition of this linkfest, or our latest monthly post (May) of the most popular books among Abnormal Returns readers. Remember anything you buy from Amazon through these links goes to support the site. Enjoy!

Finance

Book excerpt: What Todd Wenning got wrong about Tesco from Keeping Your Dividend Edge: Strategies for Growing and Protecting Your Dividends. (Monevator)

Book notes: For the Warren Buffett/Charlie Munger completist: The Buffett Essays Symposium: A 20th Anniversary Annotated Transcript by Lawrence A. Cunningham. (Reading the Markets)

Book notes: What I Learned Losing a Million Dollars [by Jim Paul and Brendan Moynihan] is easily one of the most underrated investment books I’ve come across.” (A Wealth of Common Sense)

Book list: A summer reading list from Barry Ritholtz including Investment: A History by Norton Reamer and Jesse Downing. (Bloomberg)

Book review: Family Inc.: Using Business Principles to Maximize Your Family’s Wealth by Douglas P. McCormick takes a holistic approach to effective family wealth creation. (Alpha Architect)

Book review: Hedge Fund Investing: A Practical Approach to Understanding Investor Motivation, Manager Profits, and Fund Performance by Kevin Mirabile “should be essential reading for everyone who wants to invest in, work at or sell hedge funds.” (Institutional Investor)

Book review: Ashvin Chhabra’s book The Aspirational Investor is “smart” and Fred Wilson is “enjoying it very much.” (A VC)

Book notes: The End of Accounting and the Path Forward for Investors and Managers by Baruch Lev and Feng Gu proposes wholesale changes in the way accounting deals with intangible assets. (Barron’s)

Book Q&A: Talking ETF liquidity with Eric Balchunas author of The Institutional ETF Toolbox: How Institutions Can Understand and Utilize the Fast-Growing World of ETFs. (Alpha Architect)

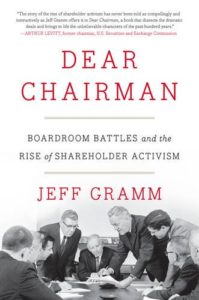

Book review: Jeff Gramm’s Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism “offers a unique entry into a previously underrepresented niche in the library of finance.” (Market Folly)

Book review: Common Stocks and Common Sense: The Strategies, Analyses, Decisions, and Emotions of a Particularly Successful Value Investor by Edgar Wachenheim III “is a delightful book.” (Reading the Markets)

Non-finance

Book excerpt: This time it is different. An excerpt from Ian Goldin and Chris Kutarna’s Age of Discovery: Navigating the Risks and Rewards of Our New Renaissance. (Scientific American)

Book review: The Golden Rules: 10 Steps to World-Class Excellence in Your Life and Work by Bob Bowman and Charles Butler on controlling what you can. (Reading the Markets)

Book notes: Robert Frank’s Success and Luck: Good Fortune and the Myth of Meritocracy should spur some debate. (Reading the Markets)

Book list: A summer reading list for financial advisors including Essentialism: The Disciplined Pursuit of Less by Greg McKeown. (Nerd’s Eye View)

Book list: The books critics say you should read this summer including The Girls: A Novel by Emma Cline. (Quartz)

Book list: The Summer’s top ten fiction books including How to Set a Fire and Why by Jesse Ball. (WSJ)

Book preview: Michael Lewis has a new book focusing on Kahneman and Tversky called The Undoing Project: A Friendship That Changed Our Minds. (NYTimes)

Book list: Books that Marc Andreessen recommends including The Song Machine: Inside the Hit Factory by John Seabrook. (Quartz)

Book review: Smarter Faster Better: The Secrets of Being Productive in Life and Business by Charles Duhigg builds on his previous work. (Knowledge@Wharton)

Book list: 14 must-read books for the Summer including Chaos Monkeys: Obscene Fortune and Random Failure in Silicon Valley by Antonio García Martínez. (Wired)

Book Q&A: Cass Sunstein’s The World According to Star Wars takes a deep intellectual dive into the series. (Marketwatch)

Book review: Angela Duckworth’s Grit: The Power of Passion and Perseverance is “an inspiring book.” (Reading the Markets)

Book review: Read Cumulus by Eliot Peper before its sci-fi dystopia becomes reality. (PopSci)

Book excerpt: How will our television output be remembered in the future. An excerpt from Chuck Klosterman’s But What If We’re Wrong: Thinking About the Present As If It Were the Past. (The Ringer)

Book list: 39 Summer books to check out including The Gene: An Intimate History by Siddhartha Mukherjee. (Washington Post)

Book Q&A: A discussion with Jonah Berger author of Invisible Influence: The Hidden Forces the Shape Behavior. (Longreads)

Please stay tuned for our monthly bestseller list which will appear on July 1.