Before the smart beta craze hit, the hedge fund cloning craze came alone. The idea being that piggybacking on the holdings of hedge fund managers gleaned from their 13-F filings would provide you with alpha-generating ideas. Two fund companies went so far as to create ETFs, the AlphaClone Alternative Alpha ETF ($ALFA) and Global X Guru Holdings Index ETF ($GURU), off of this strategy.

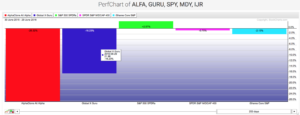

For a while their performance was pretty good. From June 5, 2012 to June 30, 2015 both $ALFA and $GURU outperformed the S&P 500 and S&P Midcap 400 indices. All good, right?

Source: StockCharts.com

Not exactly. Look what happened in the subsequent year. Even though both funds use different methodologies they have dramatically underperformed the market. The exact reasons for this underperformance are irrelevant.

Source: StockCharts.com

This post is not necessarily a criticism of these funds. Some smart people have argued that looking at 13-F filings makes a lot of sense. This post is about the challenges in following any sort of investment strategy. Every strategy goes through periods of underperformance. The question is what will you do when that time inevitably arrives?

The investors who own these funds are faced with the dilemma of whether to hold on through the rough times or switch into another strategy. You switch if you think the strategy no longer works or you have misjudged its riskiness. You hold on if the fund’s performance is in line with your earlier hypothesis.

The ETF industry has created a whole host of new factor-focused funds based on single and multi-dimensional factors. Investors in these funds will inevitably be faced with this exact same dilemma. Knowing that your time will come helps, but it is but a start.

Addendum:

@abnormalreturns Run!!! pic.twitter.com/BomVqLeVUa

— MStarETFUS (@MStarETFUS) June 30, 2016