Monday is all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including an exploration of buyback yields.

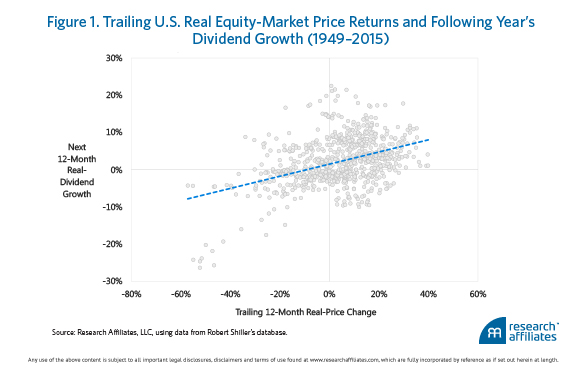

Chart of the Day

Generally the stock market gets dividend growth correctly.

Research links

- Amazon ($AMZN) star ratings may have some predictive value for stocks. (wsj.com)

- Digging into the profitability premium. (etf.com)

- The case for momentum in expensive markets. (econompicdata.blogspot.com)

- The case for a 100% stock portfolio for long term investors. (blog.alphaarchitect.com)

- The challenges of using the CAPE to forecast returns. (blogs.cfainstitute.org)

- Is infrastructure a separate asset class? (edhec.infrastructure.institute)

- US bond investors are especially prone to home country bias. (institutionalinvestor.com)

- How do researchers avoid overfitting bias? (blog.alphaarchitect.com)

- Pension fund boards matter. (etf.com)

- 401(k) providers favor their own funds. (wsj.com)

- CEOs seem to sandbag earnings calls to help themselves profit. (bloomberg.com)

- Richard Thaler on why in the future behavioral economics will fall away. (papers.ssrn.com)