Source: Indexed by Jessica Hagy

Our lives are a portfolio of assets and liabilities. Obvious assets include our earning power and investments. What we don’t likely do is think about geography affects this portfolio. For example the employment prospects of some one in New York City is very different than some one living in a small town in the Plains. These geographic decisions are a function of family, luck and sometimes conscious choice. One things individuals will to think about going forward is the affect rising sea levels will have on their choices about where to live and work.

Last month I published a post at Enterprising Investor about this topic in regards to investing and rising sea levels narrow the ‘margin of safety’ for many investments. The same is true for our lives as well.

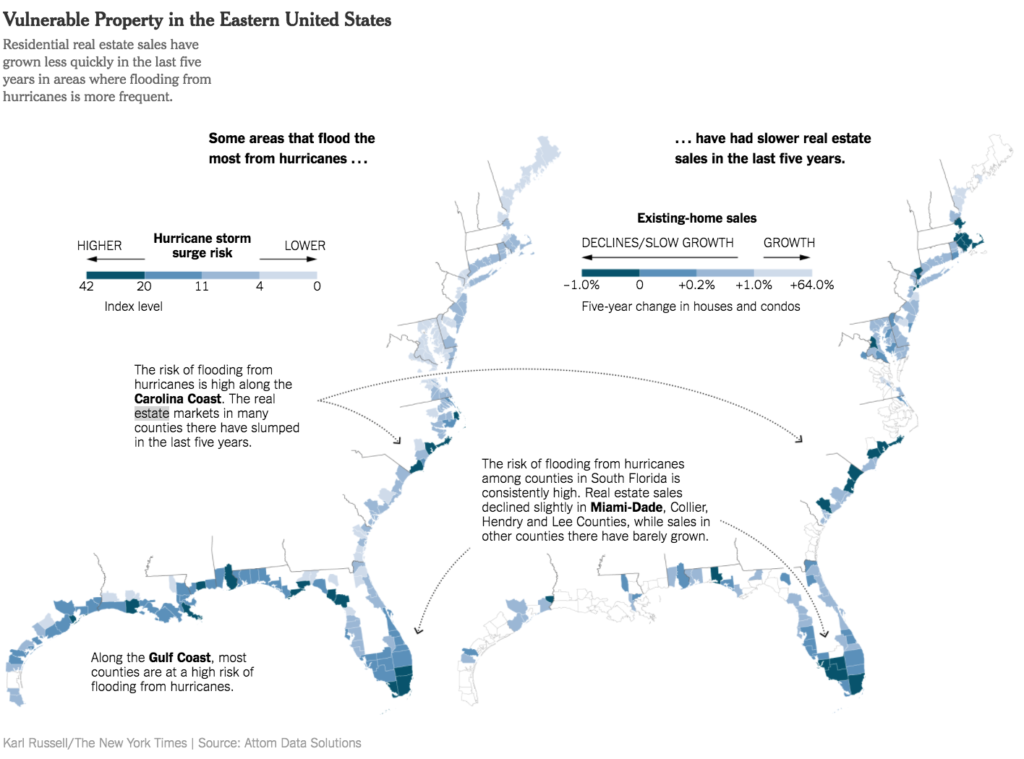

We are already beginning to see how the affects of coastal flooding and damage are affecting real estate values. Ian Urbina at NYTimes has a longer piece on areas in the US, like South Florida and North Carolina, that are seeing marked changes to their real estate markets. The graph below shows the correlation between coastal areas at-risk and slowing real estate sales over the past five years.

Source: NYTimes

Despite the evidence there is no shortage of development continuing in at-risk areas. As Urbina notes Fort Lauderdale is filled with ongoing condominium construction. James Tarmy at Bloomberg reports on the opening of a $1 billion development, the Faena District, in Miami Beach that will likely face its own water issues before too long. Michael Laas of Sustainable Futures Group says:

..current Miami development should be viewed as a combination of wishful thinking, clear-eyed realism, and pressure for short-term profits.

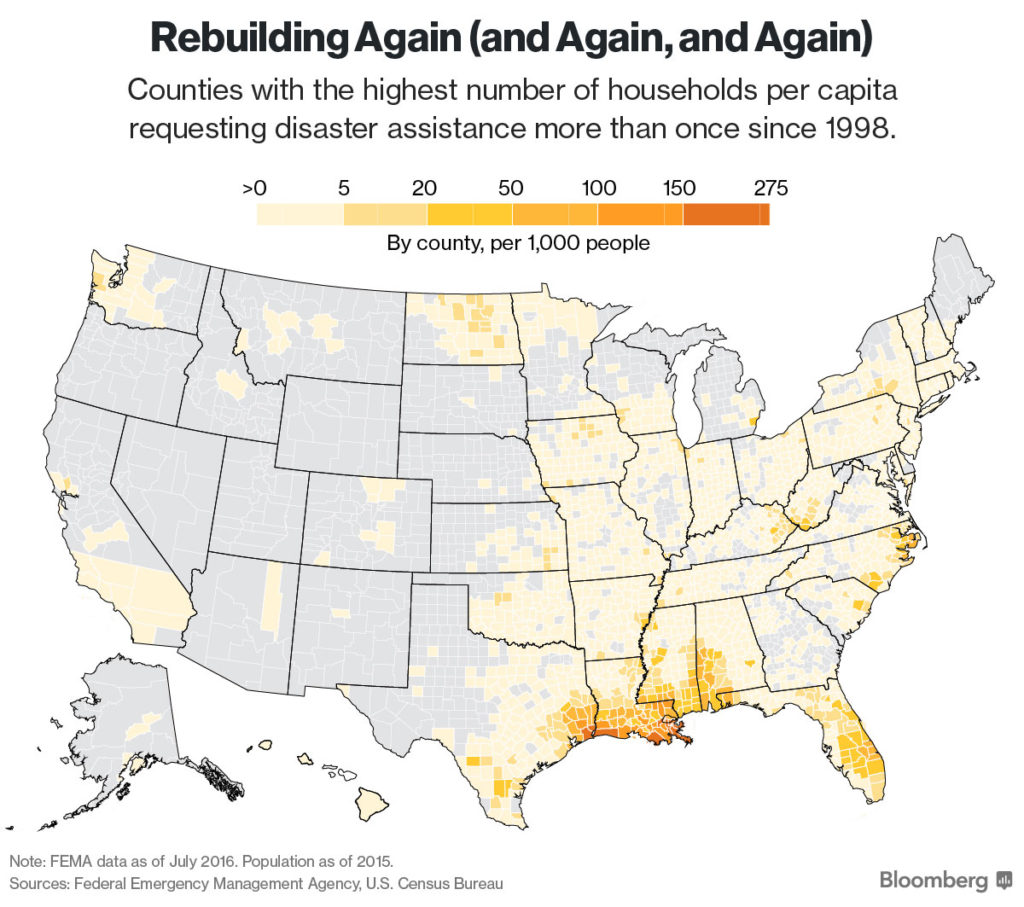

It is not like the areas that are most affected by rising sea levels aren’t already known. Christopher Flavelle at Bloomberg looks at those areas in the US that have historically requested disaster relief. The graphic below shows those areas that Flavelle thinks will at some point have to be in a certain respect abandoned to the sea.

Source: Bloomberg

It is hard for us humans to reconcile our short-term needs (and wants) with long term phenomena like climage change. Flavelle notes that as a society we are going to be increasingly facing this issue. Flavelle writes:

What’s certain is that extreme weather will only get worse, inflicting disproportionate pain on a relatively small share of the country. It’s already possible to make intelligent guesses about which areas those will be. The question for policy makers is whether to keep sheltering those people from the inevitable.

The question for the individual is different than that of society as a whole. For some, shouldering the burden of living in at-risk areas will be worth the cost. For others the costs (and anxiety) will simply be too much. There is no place that is without risk. However you should make those kind of decisions with all the information we have on hand.