Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at using factors to enhance muni bond returns.

Quote of the Day

"In a complex world, managed futures have been able to develop rules for offsetting biases and rules for finding repeatable events."

(Mark Rzepczynski)

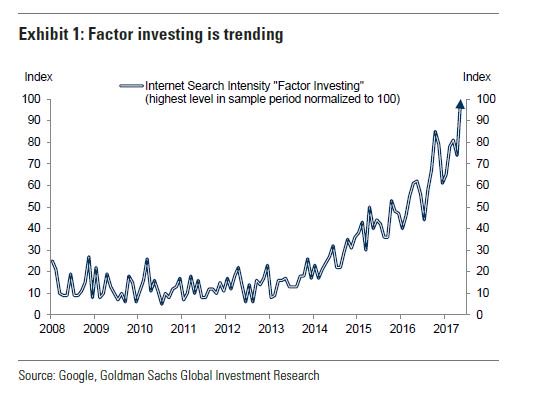

Chart of the Day

Interest in factor investing is on the rise. (via @TheStalwart)

Algos

- What a real world trading algorithm looks like. (wsj.com)

- WorldQuant University is offering students a tuition-free two-year education in financial engineering. (businessinsider.com)

Fund performance

- Information intensity doesn't correlate with better performance. (citywireusa.com)

- How active share works. (cfapubs.org)

Sponsored link

Corporate finance

- More evidence that companies cater to investors who favor dividends. (blog.alphaarchitect.com)

- Why you don't want your company's CEO to be too good a golfer. (cnbc.com)

Research

- Tips for individual investors who want to examine the academic finance literature. (aaii.com)

- The flaw with the Fundamental Law of Active Management. (investresolve.com)

- Which factors pass the test? (etf.com)

- Can we improve sector rotation? (blog.thinknewfound.com)

- How to apply return factors to the corporate bond market. (cfapubs.org)

- Does ESG investing actually make the world a better place? (aqr.com)